If you want to see how the funds you're invested in fare when it comes to environmental, social and governance factors, there's a rating for that.

The Morningstar Sustainability Rating measures how well an investment fund's holdings stack up on ESG issues compared to its peers.

The measurement is put together using the thousands of portfolios that Morningstar collects from mutual funds, ETFs and managed portfolios around the world. The firm then applies company-level data from its partner firm, Sustainalytics, to come up with asset-weighted scores for funds.

More from Impact Investing:

Leonardo DiCaprio invests in a greener way to save, spend

These companies do the most to help prevent climate change

How investors can save the planet and still make money

Investors can access the ratings by going to the Morningstar website. The score appears as globes, with five representing the highest score and one the lowest. Those symbols appear alongside other fund information, including an overall Morningstar rating. The top 10 percent of funds in each category receive five globes.

The score has provided a way to see how well funds that are branded as ESG funds are executing on those strategies.

"Virtually all of the intentional funds do well, meaning they score at least four or five globes," said Jon Hale, sustainability research expert at Morningstar.

Sign Up for Our Newsletter Your Wealth Weekly advice on managing your money SIGN UP NOW Get this delivered to your inbox, and more info about about our products and services.

By signing up for newsletters, you are agreeing to our Terms of Use and Privacy Policy. .investigation-wrapper .description{ text-align:center; padding-bottom:15px; } .nl-privacy{ font-size: 10px; padding-top: 20px; display:block; } .wildcard .investigation-wrapper { -webkit-box-shadow: 0px 0px 4px 0px #999999; /* Android 2.3+, iOS 4.0.2-4.2, Safari 3-4 */ box-shadow: 5px 5px 5px 0px #999989; } .subsection .investigation{ background: #efefef; border-radius: 3px; padding: 10px 20px 20px 20px; } .investigation small{white-space:normal;} .subsection .investigation h1{ text-transform: uppercase; text-align: center; font-family: "Gotham Narrow Ssm 5r"; margin-bottom: 0px; padding-bottom:0px; font-size: 18px; margin-top: 10px; word-spacing: 1.5px; color: #333333; } .subsection .investigation .headline_title { font-size: 28px; padding-top: 20px; display: block; font-family: "Gotham Narrow Ssm 7r"; padding-bottom:5px; } .subsection .email-info { background: rgba(74, 144, 226, 1); max-width: 140px; margin: 0px auto; text-align: center; padding: 6px 1px; color: #fff; border-radius: 5px; } .subsection .email-info { color:#fff; } .subsection .email-info:hover{ background: #2077B6; } body .subsection.investigation-wrapper{overflow:visible;}

Some exceptions might get just three globes if, for example, they are only underweighting just a few companies based on greenhouse-gas emissions and not applying similar standards to the rest of its holdings, Hale said.

The rating also provides a way to see how well funds that are not billed as ESG focused fare. Conventional funds can also get those high four or five globe scores, Hale noted.

Part of that is due to the fact that there are fewer ESG funds overall.

"The top third of each category gets four or five globes just by definition," Hale said. "There aren't enough intentional funds to populate those spots, so conventional funds do make it there."

show chapters

The $5 trillion global insurance industry's natural disaster problem 3:04 PM ET Fri, 15 March 2019 | 09:46

The conventional funds that tend to do well emphasize factors related to company quality, such as consistent earnings growth, competitive advantages and strong management, Hale said.

Since the rating was launched in 2016, the firm has noticed a couple of trends.

One is a record number of flows into ESG funds in the U.S. "Clearly, there's enhanced investor interest in general," Hale said.

More globes, more inflows

Another development is fund flows that correspond to the globe ratings. Research from the University of Chicago found that funds with five globe ratings attracted $24 billion in additional inflows after the first year the ratings were out. One globe funds, meanwhile, declined by about $12 billion.

"You put those two together, and I think the ratings have made some difference, for sure."

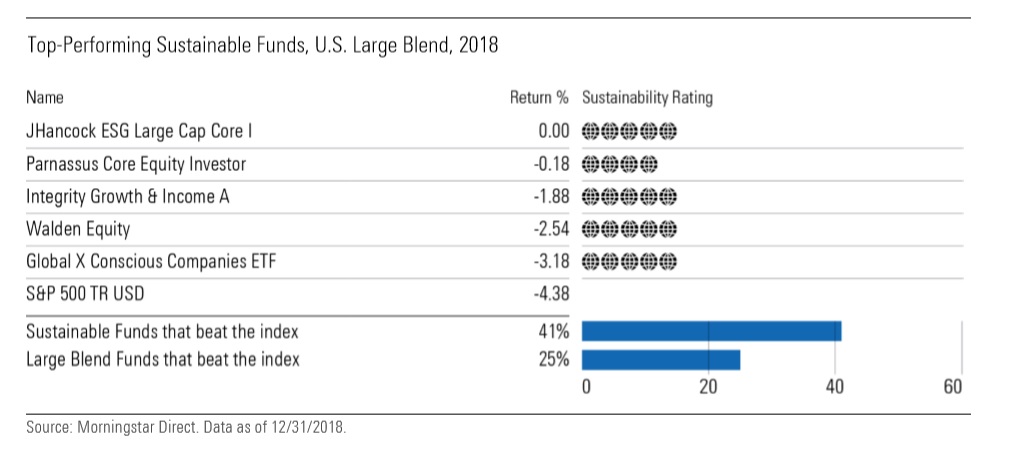

In 2018 large-blend sustainable funds outperformed conventional funds.

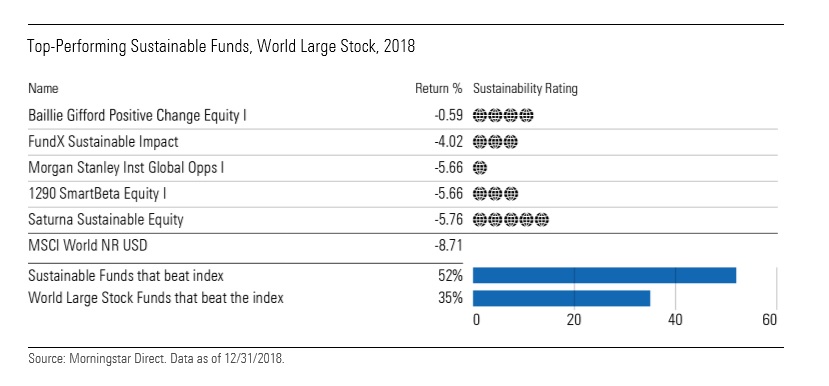

In addition, sustainable world large stock funds also outperformed last year.

The $5 trillion global insurance industry's natural disaster problem 3:04 PM ET Fri, 15 March 2019 | 09:46

The $5 trillion global insurance industry's natural disaster problem 3:04 PM ET Fri, 15 March 2019 | 09:46