In the last few years, growth of social media has overwhelmed people across the globe to such an extent that everyone from big business houses to small scale investors is trying to reap some benefit by participating in the tide. It is extremely difficult for any player to just rush into the space and establish its business among the likes of Facebook (FB) and Twitter. However, LinkedIn (LNKD) is one such company that has astutely carved out a niche market for itself and created immense value for its shareholders.

The Company Knows the Most Important Part: Good Products

The employment crisis prevailing in countries across Asia and Europe benefited LinkedIn as more and more people got on-board during the quarter to look out for opportunities. As reported, approximately 65% of its members are outside of the U.S. Besides this, the launch of relevant and innovative products throughout the quarter secured greater customer engagement.

The company released various products with the sole motive of making things convenient for its users. May it be the LinkedIn Contacts, which makes it easier for users to track meaningful conversations or empowering members to add rich media content to their profiles, LinkedIn has adopted the right strategy to survive in this industry — consistent innovation.

As per analysts, LinkedIn's PEG ratio on a five year forecast is around 2.6, which makes it a reasonable buy as compared to its peers. I say this is a justified valuation keeping in mind that the company is still very young and has a plethora of growth opportunities ahead. Also, the way it is investing money and efforts in innovation, it is sure to pay off handsomely in the near future. The company also saw a commendable increase of 68% in revenue from premium subscriptions, which testifies to the excellent quality of its offerings.

Facebook Is Trying Hard

Facebook's Graph Search has the potential to become a dangerous threat to LinkedIn as users are using it vigorously to establish professional connections and recruiters are using it to find the best candidates.

It is evident that Facebook is trying every measure possible in order to engage users on the website. Moving ahead, the company will be banking heavily on these new products to get more people on-board. I believe Facebook's share price will successfully sustain the momentum because of the stupendous growth in mobile ad revenue and frequent launch of new products/features.

Invest in LinkedIn's Growth

Getting straight to the point, I would happily invest in LinkedIn at this point, not because of its hype but for the growth opportunities that lie ahead. It is difficult to survive in an industry with such fierce competition, but LinkedIn has done it in a magnificent way. The reason for this success lies in its well-placed strategies.

An explosive growth in the next few years will come from mobile and the company has already started working on it. In April 2013, it launched a new iOS and Android app, which saw a 40% lift in mobile engagement than the previous app. I am happy to see that LinkedIn has realized the potential of mobile and started working on it to revamp the experience of its users.

One of the things that has made Google so huge is valuable and mindful acquisitions. Well, LinkedIn has cleverly followed a similar path by adding new businesses to its portfolio with the overall objective of satisfying users. Last year, it acquired the content sharing platform Slideshare, a move that is going to generate huge returns very soon.

To sum it all up, Linkedin is a superb investment for its products, opportunities and an efficient management team.

| Currently 0.00/512345 Rating: 0.0/5 (0 votes) | |

Subscribe via Email

Subscribe RSS Comments Please leave your comment:

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

LNKD STOCK PRICE CHART

166.56 (1y: -7%) $(function(){var seriesOptions=[],yAxisOptions=[],name='LNKD',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1372395600000,178.3],[1372654800000,183.11],[1372741200000,182.3],[1372827600000,188.18],[1373000400000,190.3],[1373259600000,192.5],[1373346000000,189.34],[1373432400000,188.39],[1373518800000,196.57],[1373605200000,199.96],[1373864400000,198.8],[1373950800000,193.65],[1374037200000,197.94],[1374123600000,204.16],[1374210000000,199.29],[1374469200000,197.04],[1374555600000,194.51],[1374642000000,197.6],[1374728400000,203.98],[1374814800000,208.53],[1375074000000,203.71],[1375160400000,202.57],[1375246800000,203.79],[1375333200000,213],[1375419600000,235.58],[1375678800000,233.64],[1375765200000,231.77],[1375851600000,232.92],[1375938000000,232.39],[1376024400000,232.81],[1376283600000,239.65],[1376370000000,241.82],[1376456400000,236.33],[1376542800000,228.29],[1376629200000,227.01],[1376888400000,230.5],[1376974800000,231.77],[1377061200000,230.79],[1377147600000,234.25],[1377234000000,240.37],[1377493200000,242.39],[1377579600000,235.92],[1377666000000,238.88],[1377752400000,241.12],[1377838800000,240.04],[1378184400000,246.13],[1378270800000,238.93],[1378357200000,248.35],[1378443600000,253.22],[1378702800000,249.01],[1378789200000,252.17],[1378875600000,256.14],[1378962000000,249.7],[1379048400000,249.59],[1379307600000,245],[1379394000000,247.69],[1379480400000,249.58],[1379566800000,249.06],[1379653200000,243.9],[1379912400000,239.56],[1379998800000,245.8],[1380085200000,246.69],[1380171600000,254.01],[1380258000000,246.72],[1380517200000,246.06],[1380603600000,251],[1380690000000,251.19],[1380776400000,245.07],[1380862800000,244.99],[1381122000000,237.21],[1381208400000,222.73],[1381294800000,221.83],[1381381200000,227.55],[1381467600000,226.62],[1381726800000,228.5],[1381813200000,235.45],[1381899600000,238.92],[1381986000000,240],[1382072400000,250.21],[1382331600000,249.79],[1382418000000,244.95],[1382504400000,240.83],[1382590800000,243.29],[1382677200000,240.7],[! 1382936400000,243],[1383022800000,247.14],[1383109200000,224.11],[1383195600000,223.67],[1383282000000,219.9],[1383544800000,223.72],[1383631200000,224.54],[1383717600000,220.78],[1383804000000,211.47],[1383890400000,215.17],[1384149600000,211.66],[1384236000000,209.28],[1384322400000,220.77],[1384408800000,221.44],[1384495200000,231.06],[1384754400000,222.07],[1384840800000,221.38],[1384927200000,216.19],[1385013600000,220.61],[1385100000000,220.25],[1385359200000,216.62],[1385445600000,222.93],[1385532000000,223.13],[1385704800000,224.03],[1385964000000,220.39],[1386050400000,216.43],[1386136800000,219.02],[1386223200000,226.44],[1386309600000,232.99],[1386568800000,234.81],[1386655200000,236.98],[1386741600000,231.41],[1386828000000,231.74],[1386914400000,229.3],[1387173600000,228.09],[1387260000000,223.58],[1387346400000,215.42],[1387432800000,219.07],[1387519200000,218.66],[1387778400000,220.02],[1387864800000,220.3],[1388037600000,220.5],[1388124000000,216.35],[1388383200000,214.65],[1388469600000,216.83],[1388642400000,207.64],[1388728800000,207.42],[1388988000000,203.92],[1389074400000,209.64],[1389160800000,209.06],[1389247200000,215.25],[1389333600000,218.75],[1389592800000,213.54],[1389679200000,216.22],[1389765600000,216],[1389852000000,230.56],[1389938400000,219.93],[1390284000000,220.98],[1390370400000,220.48],[1390456800000,216.74],[1390543200000,217.39],[1390802400000,205.22],[1390888800000,212.69],[1390975200000,204.13],[1391061600000,212.4],[1391148000000,215.21],[1391407200000,215.4],[1391493600000,212.33],[1391580000000,214.36],[1391666400000,223.45],[1391752800000,209.59],[1392012000000,207.33],[1392098400000,202.8],[1392184800000,192.34],[1392271200000,191.67],[1392357600000,186.13],[1392703200000,191.92],[1392789600000,196.32],[1392876000000,193.39],[1392962400000,192.62],[1393221600000,199.59],[1393308000000,209.84],[1393394400000,212.8],[1393480800000,213.77],[1393567200000,204.04],[1393826400000,201.45],[1393912800000,203],[1393999200000,207.74],[1394085600000,208.81],[13941720! 00000,206! .79],[1394427600000,202.43],[1394514000000,201.5],[1394600400000,203.08],[1394686800000,197.84],[1394773200000,196.78],[1395032400000,191.81],[1395118800000,197.85],[1395205200000,201.95],[1395291600000,204.42],[1395378000000,196.72],[1395637200000,188.14],[1395723600000,184.33],[1395810000000,185.93],[1395896400000,188.54],[1395982800000,190.59],[1396242000000,184.94],[1396328400000,187.96],[1396414800000,183.38],[1396501200000,176.97],[1396587600000,165.83],[1396846800000,159.65],[1396933200000,169.1],[1397019600000,176.18],[1397106000000,169.99],[1397192400000,165.78],[1397451600000,165.78],[1397538000000,170.9],[1397624400000,171.82],[1397710800000,175.42],[1398056400000,176.9],[1398142800000,176.31],[1398229200000,175.71],[1398315600000,171.59],[1398402000000,158.17],[1398661200000,148.06],[1398747600000,153.23],[1398834000000,153.47],[1398920400000,161.22],[1399006800000,147.73],[1399266000000,150.91],[1399352400000,142.33],[1399438800000,143.37],[1399525200000,145.07],[1399611600000,148.69],[1399870800000,152.3],[1399957200000,147.67],[1400043600000,145.56],[1400130000000,147.86],[1400216400000,147.02],[1400475600000,151.44],[1400562000000,149

) offers a dividend yield of 3.42% based on Friday’s closing price of $74.21 and the company's quarterly dividend payout of 63.5 cents. The stock is up 2.6%year-to-date. Dividend.com currently rates Erie as “Neutral” with a DARS™ rating of 3,4 stars out of 5 stars.

) offers a dividend yield of 3.42% based on Friday’s closing price of $74.21 and the company's quarterly dividend payout of 63.5 cents. The stock is up 2.6%year-to-date. Dividend.com currently rates Erie as “Neutral” with a DARS™ rating of 3,4 stars out of 5 stars.

) offers a dividend yield of 2.78% based on Friday’s closing price of $57.53 and the company's quarterly dividend payout of 40 cents. The stock is down 1.17% year-to-date. Dividend.com currently rates JPM as “Neutral” with a DARS™ rating of 3.4 stars out of 5 stars.

) offers a dividend yield of 2.78% based on Friday’s closing price of $57.53 and the company's quarterly dividend payout of 40 cents. The stock is down 1.17% year-to-date. Dividend.com currently rates JPM as “Neutral” with a DARS™ rating of 3.4 stars out of 5 stars.

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS  166.56 (1y: -7%) $(function(){var seriesOptions=[],yAxisOptions=[],name='LNKD',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1372395600000,178.3],[1372654800000,183.11],[1372741200000,182.3],[1372827600000,188.18],[1373000400000,190.3],[1373259600000,192.5],[1373346000000,189.34],[1373432400000,188.39],[1373518800000,196.57],[1373605200000,199.96],[1373864400000,198.8],[1373950800000,193.65],[1374037200000,197.94],[1374123600000,204.16],[1374210000000,199.29],[1374469200000,197.04],[1374555600000,194.51],[1374642000000,197.6],[1374728400000,203.98],[1374814800000,208.53],[1375074000000,203.71],[1375160400000,202.57],[1375246800000,203.79],[1375333200000,213],[1375419600000,235.58],[1375678800000,233.64],[1375765200000,231.77],[1375851600000,232.92],[1375938000000,232.39],[1376024400000,232.81],[1376283600000,239.65],[1376370000000,241.82],[1376456400000,236.33],[1376542800000,228.29],[1376629200000,227.01],[1376888400000,230.5],[1376974800000,231.77],[1377061200000,230.79],[1377147600000,234.25],[1377234000000,240.37],[1377493200000,242.39],[1377579600000,235.92],[1377666000000,238.88],[1377752400000,241.12],[1377838800000,240.04],[1378184400000,246.13],[1378270800000,238.93],[1378357200000,248.35],[1378443600000,253.22],[1378702800000,249.01],[1378789200000,252.17],[1378875600000,256.14],[1378962000000,249.7],[1379048400000,249.59],[1379307600000,245],[1379394000000,247.69],[1379480400000,249.58],[1379566800000,249.06],[1379653200000,243.9],[1379912400000,239.56],[1379998800000,245.8],[1380085200000,246.69],[1380171600000,254.01],[1380258000000,246.72],[1380517200000,246.06],[1380603600000,251],[1380690000000,251.19],[1380776400000,245.07],[1380862800000,244.99],[1381122000000,237.21],[1381208400000,222.73],[1381294800000,221.83],[1381381200000,227.55],[1381467600000,226.62],[1381726800000,228.5],[1381813200000,235.45],[1381899600000,238.92],[1381986000000,240],[1382072400000,250.21],[1382331600000,249.79],[1382418000000,244.95],[1382504400000,240.83],[1382590800000,243.29],[1382677200000,240.7],[! 1382936400000,243],[1383022800000,247.14],[1383109200000,224.11],[1383195600000,223.67],[1383282000000,219.9],[1383544800000,223.72],[1383631200000,224.54],[1383717600000,220.78],[1383804000000,211.47],[1383890400000,215.17],[1384149600000,211.66],[1384236000000,209.28],[1384322400000,220.77],[1384408800000,221.44],[1384495200000,231.06],[1384754400000,222.07],[1384840800000,221.38],[1384927200000,216.19],[1385013600000,220.61],[1385100000000,220.25],[1385359200000,216.62],[1385445600000,222.93],[1385532000000,223.13],[1385704800000,224.03],[1385964000000,220.39],[1386050400000,216.43],[1386136800000,219.02],[1386223200000,226.44],[1386309600000,232.99],[1386568800000,234.81],[1386655200000,236.98],[1386741600000,231.41],[1386828000000,231.74],[1386914400000,229.3],[1387173600000,228.09],[1387260000000,223.58],[1387346400000,215.42],[1387432800000,219.07],[1387519200000,218.66],[1387778400000,220.02],[1387864800000,220.3],[1388037600000,220.5],[1388124000000,216.35],[1388383200000,214.65],[1388469600000,216.83],[1388642400000,207.64],[1388728800000,207.42],[1388988000000,203.92],[1389074400000,209.64],[1389160800000,209.06],[1389247200000,215.25],[1389333600000,218.75],[1389592800000,213.54],[1389679200000,216.22],[1389765600000,216],[1389852000000,230.56],[1389938400000,219.93],[1390284000000,220.98],[1390370400000,220.48],[1390456800000,216.74],[1390543200000,217.39],[1390802400000,205.22],[1390888800000,212.69],[1390975200000,204.13],[1391061600000,212.4],[1391148000000,215.21],[1391407200000,215.4],[1391493600000,212.33],[1391580000000,214.36],[1391666400000,223.45],[1391752800000,209.59],[1392012000000,207.33],[1392098400000,202.8],[1392184800000,192.34],[1392271200000,191.67],[1392357600000,186.13],[1392703200000,191.92],[1392789600000,196.32],[1392876000000,193.39],[1392962400000,192.62],[1393221600000,199.59],[1393308000000,209.84],[1393394400000,212.8],[1393480800000,213.77],[1393567200000,204.04],[1393826400000,201.45],[1393912800000,203],[1393999200000,207.74],[1394085600000,208.81],[13941720! 00000,206! .79],[1394427600000,202.43],[1394514000000,201.5],[1394600400000,203.08],[1394686800000,197.84],[1394773200000,196.78],[1395032400000,191.81],[1395118800000,197.85],[1395205200000,201.95],[1395291600000,204.42],[1395378000000,196.72],[1395637200000,188.14],[1395723600000,184.33],[1395810000000,185.93],[1395896400000,188.54],[1395982800000,190.59],[1396242000000,184.94],[1396328400000,187.96],[1396414800000,183.38],[1396501200000,176.97],[1396587600000,165.83],[1396846800000,159.65],[1396933200000,169.1],[1397019600000,176.18],[1397106000000,169.99],[1397192400000,165.78],[1397451600000,165.78],[1397538000000,170.9],[1397624400000,171.82],[1397710800000,175.42],[1398056400000,176.9],[1398142800000,176.31],[1398229200000,175.71],[1398315600000,171.59],[1398402000000,158.17],[1398661200000,148.06],[1398747600000,153.23],[1398834000000,153.47],[1398920400000,161.22],[1399006800000,147.73],[1399266000000,150.91],[1399352400000,142.33],[1399438800000,143.37],[1399525200000,145.07],[1399611600000,148.69],[1399870800000,152.3],[1399957200000,147.67],[1400043600000,145.56],[1400130000000,147.86],[1400216400000,147.02],[1400475600000,151.44],[1400562000000,149

166.56 (1y: -7%) $(function(){var seriesOptions=[],yAxisOptions=[],name='LNKD',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1372395600000,178.3],[1372654800000,183.11],[1372741200000,182.3],[1372827600000,188.18],[1373000400000,190.3],[1373259600000,192.5],[1373346000000,189.34],[1373432400000,188.39],[1373518800000,196.57],[1373605200000,199.96],[1373864400000,198.8],[1373950800000,193.65],[1374037200000,197.94],[1374123600000,204.16],[1374210000000,199.29],[1374469200000,197.04],[1374555600000,194.51],[1374642000000,197.6],[1374728400000,203.98],[1374814800000,208.53],[1375074000000,203.71],[1375160400000,202.57],[1375246800000,203.79],[1375333200000,213],[1375419600000,235.58],[1375678800000,233.64],[1375765200000,231.77],[1375851600000,232.92],[1375938000000,232.39],[1376024400000,232.81],[1376283600000,239.65],[1376370000000,241.82],[1376456400000,236.33],[1376542800000,228.29],[1376629200000,227.01],[1376888400000,230.5],[1376974800000,231.77],[1377061200000,230.79],[1377147600000,234.25],[1377234000000,240.37],[1377493200000,242.39],[1377579600000,235.92],[1377666000000,238.88],[1377752400000,241.12],[1377838800000,240.04],[1378184400000,246.13],[1378270800000,238.93],[1378357200000,248.35],[1378443600000,253.22],[1378702800000,249.01],[1378789200000,252.17],[1378875600000,256.14],[1378962000000,249.7],[1379048400000,249.59],[1379307600000,245],[1379394000000,247.69],[1379480400000,249.58],[1379566800000,249.06],[1379653200000,243.9],[1379912400000,239.56],[1379998800000,245.8],[1380085200000,246.69],[1380171600000,254.01],[1380258000000,246.72],[1380517200000,246.06],[1380603600000,251],[1380690000000,251.19],[1380776400000,245.07],[1380862800000,244.99],[1381122000000,237.21],[1381208400000,222.73],[1381294800000,221.83],[1381381200000,227.55],[1381467600000,226.62],[1381726800000,228.5],[1381813200000,235.45],[1381899600000,238.92],[1381986000000,240],[1382072400000,250.21],[1382331600000,249.79],[1382418000000,244.95],[1382504400000,240.83],[1382590800000,243.29],[1382677200000,240.7],[! 1382936400000,243],[1383022800000,247.14],[1383109200000,224.11],[1383195600000,223.67],[1383282000000,219.9],[1383544800000,223.72],[1383631200000,224.54],[1383717600000,220.78],[1383804000000,211.47],[1383890400000,215.17],[1384149600000,211.66],[1384236000000,209.28],[1384322400000,220.77],[1384408800000,221.44],[1384495200000,231.06],[1384754400000,222.07],[1384840800000,221.38],[1384927200000,216.19],[1385013600000,220.61],[1385100000000,220.25],[1385359200000,216.62],[1385445600000,222.93],[1385532000000,223.13],[1385704800000,224.03],[1385964000000,220.39],[1386050400000,216.43],[1386136800000,219.02],[1386223200000,226.44],[1386309600000,232.99],[1386568800000,234.81],[1386655200000,236.98],[1386741600000,231.41],[1386828000000,231.74],[1386914400000,229.3],[1387173600000,228.09],[1387260000000,223.58],[1387346400000,215.42],[1387432800000,219.07],[1387519200000,218.66],[1387778400000,220.02],[1387864800000,220.3],[1388037600000,220.5],[1388124000000,216.35],[1388383200000,214.65],[1388469600000,216.83],[1388642400000,207.64],[1388728800000,207.42],[1388988000000,203.92],[1389074400000,209.64],[1389160800000,209.06],[1389247200000,215.25],[1389333600000,218.75],[1389592800000,213.54],[1389679200000,216.22],[1389765600000,216],[1389852000000,230.56],[1389938400000,219.93],[1390284000000,220.98],[1390370400000,220.48],[1390456800000,216.74],[1390543200000,217.39],[1390802400000,205.22],[1390888800000,212.69],[1390975200000,204.13],[1391061600000,212.4],[1391148000000,215.21],[1391407200000,215.4],[1391493600000,212.33],[1391580000000,214.36],[1391666400000,223.45],[1391752800000,209.59],[1392012000000,207.33],[1392098400000,202.8],[1392184800000,192.34],[1392271200000,191.67],[1392357600000,186.13],[1392703200000,191.92],[1392789600000,196.32],[1392876000000,193.39],[1392962400000,192.62],[1393221600000,199.59],[1393308000000,209.84],[1393394400000,212.8],[1393480800000,213.77],[1393567200000,204.04],[1393826400000,201.45],[1393912800000,203],[1393999200000,207.74],[1394085600000,208.81],[13941720! 00000,206! .79],[1394427600000,202.43],[1394514000000,201.5],[1394600400000,203.08],[1394686800000,197.84],[1394773200000,196.78],[1395032400000,191.81],[1395118800000,197.85],[1395205200000,201.95],[1395291600000,204.42],[1395378000000,196.72],[1395637200000,188.14],[1395723600000,184.33],[1395810000000,185.93],[1395896400000,188.54],[1395982800000,190.59],[1396242000000,184.94],[1396328400000,187.96],[1396414800000,183.38],[1396501200000,176.97],[1396587600000,165.83],[1396846800000,159.65],[1396933200000,169.1],[1397019600000,176.18],[1397106000000,169.99],[1397192400000,165.78],[1397451600000,165.78],[1397538000000,170.9],[1397624400000,171.82],[1397710800000,175.42],[1398056400000,176.9],[1398142800000,176.31],[1398229200000,175.71],[1398315600000,171.59],[1398402000000,158.17],[1398661200000,148.06],[1398747600000,153.23],[1398834000000,153.47],[1398920400000,161.22],[1399006800000,147.73],[1399266000000,150.91],[1399352400000,142.33],[1399438800000,143.37],[1399525200000,145.07],[1399611600000,148.69],[1399870800000,152.3],[1399957200000,147.67],[1400043600000,145.56],[1400130000000,147.86],[1400216400000,147.02],[1400475600000,151.44],[1400562000000,149

Popular Posts: 5 Stocks Ready to Bloom in SpringGoogle Stock Split Is All Good For GOOG Investors3 Stocks to Buy Now That Spring is In the Air Recent Posts: Here Is Your Guide for Q1 Earnings Season Leave CarMax Stock on the Lot For Now (KMX) Don’t Panic Out of Barnes & Noble Stock Yet View All Posts

Popular Posts: 5 Stocks Ready to Bloom in SpringGoogle Stock Split Is All Good For GOOG Investors3 Stocks to Buy Now That Spring is In the Air Recent Posts: Here Is Your Guide for Q1 Earnings Season Leave CarMax Stock on the Lot For Now (KMX) Don’t Panic Out of Barnes & Noble Stock Yet View All Posts  Shares of CarMax (KMX) stock retreated after the used automobile retailer reported 9% fourth-quarter sales growth and a billion-dollar increase to its ongoing stock buyback program. Huh? What spooked investors? And is this a buying opportunity for CarMax stock or a sign that CarMax is stopped at a red light?

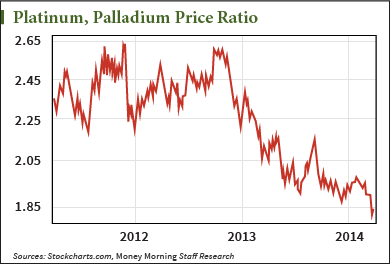

Shares of CarMax (KMX) stock retreated after the used automobile retailer reported 9% fourth-quarter sales growth and a billion-dollar increase to its ongoing stock buyback program. Huh? What spooked investors? And is this a buying opportunity for CarMax stock or a sign that CarMax is stopped at a red light? And while we're palladium chart gazing, have a close look at this next one.

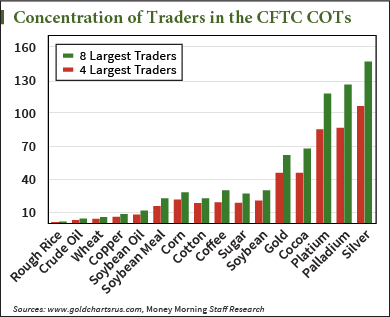

And while we're palladium chart gazing, have a close look at this next one. Today, palladium's still short about 127 days of production by its eight largest futures traders. The only thing that's changed is that silver has taken over the first spot in the chart.

Today, palladium's still short about 127 days of production by its eight largest futures traders. The only thing that's changed is that silver has taken over the first spot in the chart.  As today's Bitcoin startups make the digital currency easier to use, those advantages will become more apparent to the general public, setting off a mass transition away from traditional forms of payment such as credit cards.

As today's Bitcoin startups make the digital currency easier to use, those advantages will become more apparent to the general public, setting off a mass transition away from traditional forms of payment such as credit cards.

Associated Press

Associated Press  On the one hand, marijuana stocks — as sketchy as they are – would get a huge lift on impending legalization at the federal level. Heck, the entire sector of dubious over-the-counter medical marijuana stocks took off when only the states of Colorado and Washington legalized the drug.

On the one hand, marijuana stocks — as sketchy as they are – would get a huge lift on impending legalization at the federal level. Heck, the entire sector of dubious over-the-counter medical marijuana stocks took off when only the states of Colorado and Washington legalized the drug.