Linked here is a detailed quantitative analysis of Cincinnati Financial Corp. (CINF). Below are some highlights from the above linked analysis: Company Description: Cincinnati Financial Corp. is an insurance holding company that primarily markets property and casualty coverage. It also conducts life insurance and asset management operations.

Fair Value: In calculating fair value, I consider the NPV MMA Differential Fair Value along with these four calculations of fair value, see page 2 of the linked PDF for a detailed description: 1. Avg. High Yield Price 2. 20-Year DCF Price 3. Avg. P/E Price 4. Graham Number CINF is trading at a discount to only 3.) above. The stock is trading at a 36.8% premium to its calculated fair value of $34.96. CINF did not earn any Stars in this section. Dividend Analytical Data: In this section there are three possible Stars and three key metrics, see page 2 of the linked PDF for a detailed description: 1. Free Cash Flow Payout 2. Debt To Total Capital 3. Key Metrics 4. Dividend Growth Rate 5. Years of Div. Growth 6. Rolling 4-yr Div. > 15% CINF earned two Stars in this section for 1.) and 2.) above. A Star was earned since the Free Cash Flow payout ratio was less than 60% and there were no negative Free Cash Flows over the last 10 years. The stock earned a Star as a result of its most recent Debt to Total Capital being less than 45%. The company has paid a cash dividend to shareholders every year since 1954 and has increased its dividend payments for 54 consecutive years. Dividend Income vs. MMA: Why would you assume the equity risk and invest in a dividend stock if you could earn a better return in a much less risky money market account (MMA) or Treasury bond? This section compares the earning ability of this stock with a high yield MMA. Two items are considered in this section, see page 2 of the linked PDF for a detailed description: 1. NPV MMA Diff. 2. Years to > MMA The NPV MMA Diff. of the $62 is below the $500 target I look for in a stock that has increased dividends as long as CINF has. If CINF grows its dividend at 1.2% per year, it will take 5 years to equal a MMA yielding an estimated 20-year average rate of 3.68%. Memberships and Peers: CINF is a member of the S&P 500, a Dividend Aristocrat, a member of the Broad Dividend Achievers™ Index and a Dividend Champion. The company's peer group includes: Axis Capital Holdings Ltd. (AXS) with a 2.3% yield, The Allstate Corporation (ALL) with a 2.0% yield, and The Travelers Companies Inc. (TRV) with a 2.4% yield. Conclusion: CINF did not earn any Stars in the Fair Value section, earned two Stars in the Dividend Analytical Data section and did not earn any Stars in the Dividend Income vs. MMA section for a total of two Stars. This quantitatively ranks CINF as a 2-Star Weak stock. Using my D4L-PreScreen.xls model, I determined the share price would need to decrease to $35.00 before CINF's NPV MMA Differential increased to the $500 minimum that I look for in a stock with 54 years of consecutive dividend increases. At that price the stock would yield 4.8%. Resetting the D4L-PreScreen.xls model and solving for the dividend growth rate needed to generate the target $500 NPV MMA Differential, the calculated rate is 1.2%. This dividend growth rate is equal to the 1.2% used in this analysis, thus providing no margin of safety. CINF has a risk rating of 1.5 which classifies it as a Low risk stock. CINF was founded by independent insurance agents in order to better service their needs by providing them preferential treatment when picking an underwriter. The company primarily sells commercial property-casualty insurance with a smaller personal lines exposure marketed through a select group of independent insurance agencies. CINF is more heavily exposed to equity risk than its peers; however management is taking steps to re-balance its investments. The company should benefit from an improving pricing environment and steps management has taken to expand its operations. Weather losses from the Two winter storms in the first week of January 2014 willlikely adversely affect CINF's by an estimated $65 million to $85 million. Low interest rates could adversely affect investment income, which is an important component of the company's revenues and net income. The company's financial results have always been volatile due to weather events. However, its strategic initiatives will continue to generate returns over time. The company enjoys a low debt to total capital of 13% and currently has a FCF Payout of 35%, down from 44% in my last analysis. However, the stock is trading at a significant premium to my calculated fair value of $34.96. However, based on dividend fundamentals, I am will continue to look for opportunities to buy. Disclaimer: Material presented here is for informational purposes only. The above quantitative stock analysis, including the Star rating, is mechanically calculated and is based on historical information. The analysis assumes the stock will perform in the future as it has in the past. This is generally never true. Before buying or selling any stock you should do your own research and reach your own conclusion. See my Disclaimer for more information. Full Disclosure: At the time of this writing, I was long in CINF (3.5% of my Dividend Growth Portfolio). See a list of all my dividend growth holdings here. Related Articles: - Archer Daniels Midland Company (ADM) Dividend Stock Analysis - McDonald's Corporation (MCD) Dividend Stock Analysis - Lockheed Martin Corp. (LMT) Dividend Stock Analysis - ConocoPhillips Co. (COP) Dividend Stock Analysis - More Stock Analysis

About the author:Dividends4LifeVisit Dividends4Life at: http://www.dividend-growth-stocks.com/

| Currently 5.00/512345 Rating: 5.0/5 (2 votes) | Voters:  |

Subscribe via Email

Subscribe RSS Comments Please leave your comment:

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

CINF STOCK PRICE CHART

47.18 (1y: +0%) $(function(){var seriesOptions=[],yAxisOptions=[],name='CINF',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1363323600000,46.98],[1363582800000,46.17],[1363669200000,46.18],[1363755600000,46.51],[1363842000000,46.2],[1363928400000,46.36],[1364187600000,46.41],[1364274000000,46.95],[1364360400000,46.89],[1364446800000,47.22],[1364792400000,47.12],[1364878800000,47.53],[1364965200000,47.43],[1365051600000,47.55],[1365138000000,47.36],[1365397200000,47.79],[1365483600000,47.66],[1365570000000,48.36],[1365656400000,49.03],[1365742800000,48.8],[1366002000000,48.05],[1366088400000,48.77],[1366174800000,47.65],[1366261200000,46.81],[1366347600000,47.68],[1366606800000,47.98],[1366693200000,48.67],[1366779600000,48.94],[1366866000000,48.9],[1366952400000,48.1],[1367211600000,48.29],[1367298000000,48.91],[1367384400000,48.35],[1367470800000,48.72],[1367557200000,49.26],[1367816400000,49.4],[1367902800000,49.31],[1367989200000,49.47],[1368075600000,49.11],[1368162000000,49.31],[1368421200000,49.5],[1368507600000,50.22],[1368594000000,50.35],[1368680400000,49.34],[1368766800000,49.66],[1369026000000,49.2],[1369112400000,48.4],[1369198800000,47.9],[1369285200000,47.75],[1369371600000,47.93],[1369717200000,48.09],[1369803600000,47.54],[1369890000000,48.01],[1369976400000,47.34],[1370235600000,47.14],[1370322000000,46.19],[1370408400000,45.59],[1370494800000,45.95],[1370581200000,46.46],[1370840400000,46.49],[1370926800000,45.51],[1371013200000,45.64],[1371099600000,46.44],[1371186000000,46.18],[1371445200000,46.83],[1371531600000,47.1],[1371618000000,46.27],[1371704400000,45.29],[1371790800000,45.4],[1372050000000,44.77],[1372136400000,45.05],[1372222800000,45.64],[1372309200000,46.26],[1372395600000,45.92],[1372654800000,46.54],[1372741200000,46.33],[1372827600000,46.32],[1373000400000,46.64],[1373259600000,47.4],[1373346000000,48.1],[1373432400000,48.51],[1373518800000,48.83],[1373605200000,49.18],[1373864400000,49.4],[1373950800000,48.98],[1374037200000,49.04],[1374123600000,49.62],[13742100! 00000,49..55],[1374469200000,50],[1374555600000,49.52],[1374642000000,48.68],[1374728400000,48.89],[1374814800000,49.12],[1375074000000,49.1],[1375160400000,48.93],[1375246800000,49.01],[1375333200000,49.92],[1375419600000,49.74],[1375678800000,49.12],[1375765200000,48.75],[1375851600000,48.55],[1375938000000,48.73],[1376024400000,48.66],[1376283600000,48.53],[1376370000000,48.75],[1376456400000,48.9],[1376542800000,47.75],[1376629200000,47.76],[1376888400000,47.19],[1376974800000,47.49],[1377061200000,47.1],[1377147600000,47.53],[1377234000000,47.38],[1377493200000,46.91],[1377579600000,46.26],[1377666000000,45.98],[1377752400000,46.2],[1377838800000,45.68],[1378184400000,45.8],[1378270800000,46],[1378357200000,46.02],[1378443600000,45.59],[1378702800000,46.25],[1378789200000,46.62],[1378875600000,46.5],[1378962000000,46.3],[1379048400000,46.56],[1379307600000,46.77],[1379394000000,46.75],[1379480400000,47.2],[1379566800000,47.38],[1379653200000,47.44],[1379912400000,47.02],[1379998800000,47.01],[1380085200000,47.14],[1380171600000,47.25],[1380258000000,47.46],[1380517200000,47.16],[1380603600000,47.3],[1380690000000,47.55],[1380776400000,47.06],[1380862800000,47.63],[1381122000000,47.5],[1381208400000,47.13],[1381294800000,47.11],[1381381200000,48.46],[1381467600000,48.56],[1381726800000,48.99],[1381813200000,48.67],[1381899600000,49.46],[1381986000000,49.86],[1382072400000,49.99],[1382331600000,49.95],[1382418000000,50.33],[1382504400000,50.13],[1382590800000,50.32],[1382677200000,50.18],[1382936400000,50.3],[1383022800000,50.63],[1383109200000,50.56],[1383195600000,50.05],[1383282000000,50],[1383544800000,49.91],[1383631200000,49.67],[1383717600000,50.24],[1383804000000,49.62],[1383890400000,50.57],[1384149600000,50.59],[1384236000000,50.12],[1384322400000,50.52],[1384408800000,50.89],[1384495200000,51.08],[1384754400000,50.9],[1384840800000,51.13],[1384927200000,50.94],[1385013600000,51.91],[1385100000000,52.41],[1385359200000,52.66],[1385445600000,52.69],[1385532000000,52.95],[1385704800000,52.41]! ,[13859640! 00000,52.15],[1386050400000,51.86],[1386136800000,51.68],[1386223200000,51.39],[1386309600000,52.28],[1386568800000,52.24],[1386655200000,52.02],[1386741600000,51.39],[1386828000000,51.33],[1386914400000,51.22],[1387173600000,50.83],[1387260000000,50.67],[1387346400000,51.52],[1387432800000,51.4],[1387519200000,52.01],[1387778400000,52.05],[1387864800000,52.22],[1388037600000,52.38],[1388124000000,51.98],[1388383200000,52.25],[1388469600000,52.37],[1388642400000,51.45],[1388728800000,51.13],[1388988000000,51],[1389074400000,51.05],[1389160800000,50.89],[1389247200000,51.11],[1389333600000,51.15],[1389592800000,50.51],[1389679200000,50.8],[1389765600000,50.87],[1389852000000,50.51],[1389938400000,50.52],[1390284000000,50.48],[1390370400000,50.7],[1390456800000,50.14],[1390543200000,48.81],[1390802400000,48.77],[1390888800000,49.26],[1390975200000,48.61],[1391061600000,49.23],[1391148000000,48.45],[1391407200000,47.61],[1391493600000,47.25],[1391580000000,47.1],[1391666400000,45.21],[1391752800000,45.73],[1392012000000,45.78],[1392098400000,46.32],[1392184800000,46.51],[1392271200000,46.92],[139235760

Name: John Grover Wilson

Name: John Grover Wilson Name: David S. Chang

Name: David S. Chang Name: John Thomas Deutsch

Name: John Thomas Deutsch Name: Kevin Hott

Name: Kevin Hott Name: David Latch

Name: David Latch Name: James Schwartz

Name: James Schwartz Name: Robert S. Peterson

Name: Robert S. Peterson Name: Bill Gross

Name: Bill Gross

The deal follows on the heels of United Capital’s July 1 announcement that it had acquired the majority of assets from Georgia-based PPA Advisors. Combined, the two acquisitions will give United Capital a broader footprint in the East Coast.

The deal follows on the heels of United Capital’s July 1 announcement that it had acquired the majority of assets from Georgia-based PPA Advisors. Combined, the two acquisitions will give United Capital a broader footprint in the East Coast. netflix.com Netflix (NFLX) is still growing, but it's not growing fast enough. The world's leading premium video service took a hit after posting disappointing quarterly results on Wednesday night. The stock-rattling shocker is that Netflix ended the third quarter with 53.06 million streaming subscribers worldwide. That's 3 million more than it had at the end of June, but Netflix itself was forecasting 53.74 million accounts. Netflix is typically conservative with its guidance, making the shortfall as troubling as it is surprising. It has a scapegoat. It's pointing to its springtime rate increase as the primary cause for its blown forecast. "Slightly higher prices result in slightly less growth, other things being equal, and this is manifested more clearly in higher adoption markets such as the U.S.," Netflix notes in its letter to shareholders. When it issued its forecast in late July it was still basking in the magnetism of the second season of "Orange Is the New Black" that resulted in a healthy trickle of signups. Once that buzz subsided, new members became harder to come by. Bucking the Trend Netflix's move to increase the monthly rate in May didn't take the market by surprise. A few months earlier it had announced in an earnings call that it was entertaining a hike. It was pondering $8.99 or $9.99 as the new monthly rate, up from the original $7.99. It chose the lower of the two increases. Existing subscribers were fine with the move. Netflix promised to grandfather them in at $7.99 a month for two years. The market understood, and that was something that couldn't be said a few years ago when there was widespread outrage about Netflix splitting its DVD and streaming services. Customers on DVD-based plans would have to pay as much as 60 percent more if they wanted to continue to stream content, too. May's increase was the first time that Netflix had increased the rate of its stand-alone DVD service. It seemed as if it would be able to pull it off without a hitch, but now, potential new customers appear to be balking. HBO on the Go With Redbox Instant shutting down and Streampix redefining its value proposition, the competition seemed to be caving in to Netflix. However, just hours before Netflix's report, Time Warner's (TWX) HBO suggested that it will roll out a stand-alone streaming service in this country. HBO didn't offer pricing or a timetable for its availability, but it's an interesting move for a company that Netflix CEO Reed Hasting has often considered its biggest rival. This may make it seem like an unfortunate time for Netflix to be increasing prices, but since HBO charges roughly twice as much as Netflix for its cable-based offering, it's unlikely to be much of an issue here. Netflix is looking to land more than 4 million net new streaming additions during the current quarter. It's targeting to surpass 57 million streaming members by year's end, and that forecast is taking into consideration the slowdown since the price hike. Netflix will be fine, even if the stock action paints a bleaker portrait. More from Rick Aristotle Munarriz

netflix.com Netflix (NFLX) is still growing, but it's not growing fast enough. The world's leading premium video service took a hit after posting disappointing quarterly results on Wednesday night. The stock-rattling shocker is that Netflix ended the third quarter with 53.06 million streaming subscribers worldwide. That's 3 million more than it had at the end of June, but Netflix itself was forecasting 53.74 million accounts. Netflix is typically conservative with its guidance, making the shortfall as troubling as it is surprising. It has a scapegoat. It's pointing to its springtime rate increase as the primary cause for its blown forecast. "Slightly higher prices result in slightly less growth, other things being equal, and this is manifested more clearly in higher adoption markets such as the U.S.," Netflix notes in its letter to shareholders. When it issued its forecast in late July it was still basking in the magnetism of the second season of "Orange Is the New Black" that resulted in a healthy trickle of signups. Once that buzz subsided, new members became harder to come by. Bucking the Trend Netflix's move to increase the monthly rate in May didn't take the market by surprise. A few months earlier it had announced in an earnings call that it was entertaining a hike. It was pondering $8.99 or $9.99 as the new monthly rate, up from the original $7.99. It chose the lower of the two increases. Existing subscribers were fine with the move. Netflix promised to grandfather them in at $7.99 a month for two years. The market understood, and that was something that couldn't be said a few years ago when there was widespread outrage about Netflix splitting its DVD and streaming services. Customers on DVD-based plans would have to pay as much as 60 percent more if they wanted to continue to stream content, too. May's increase was the first time that Netflix had increased the rate of its stand-alone DVD service. It seemed as if it would be able to pull it off without a hitch, but now, potential new customers appear to be balking. HBO on the Go With Redbox Instant shutting down and Streampix redefining its value proposition, the competition seemed to be caving in to Netflix. However, just hours before Netflix's report, Time Warner's (TWX) HBO suggested that it will roll out a stand-alone streaming service in this country. HBO didn't offer pricing or a timetable for its availability, but it's an interesting move for a company that Netflix CEO Reed Hasting has often considered its biggest rival. This may make it seem like an unfortunate time for Netflix to be increasing prices, but since HBO charges roughly twice as much as Netflix for its cable-based offering, it's unlikely to be much of an issue here. Netflix is looking to land more than 4 million net new streaming additions during the current quarter. It's targeting to surpass 57 million streaming members by year's end, and that forecast is taking into consideration the slowdown since the price hike. Netflix will be fine, even if the stock action paints a bleaker portrait. More from Rick Aristotle Munarriz Brandon Schulman for The Wall St

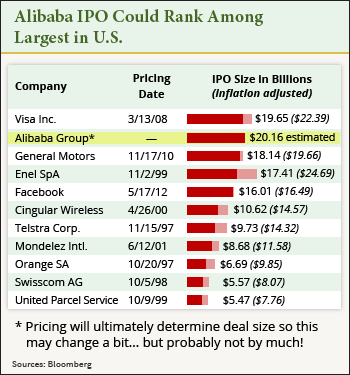

Brandon Schulman for The Wall St  Some reports indicate that the Alibaba IPO date could be scheduled for the first week in August, but no official date has been set.

Some reports indicate that the Alibaba IPO date could be scheduled for the first week in August, but no official date has been set.

47.18 (1y: +0%) $(function(){var seriesOptions=[],yAxisOptions=[],name='CINF',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1363323600000,46.98],[1363582800000,46.17],[1363669200000,46.18],[1363755600000,46.51],[1363842000000,46.2],[1363928400000,46.36],[1364187600000,46.41],[1364274000000,46.95],[1364360400000,46.89],[1364446800000,47.22],[1364792400000,47.12],[1364878800000,47.53],[1364965200000,47.43],[1365051600000,47.55],[1365138000000,47.36],[1365397200000,47.79],[1365483600000,47.66],[1365570000000,48.36],[1365656400000,49.03],[1365742800000,48.8],[1366002000000,48.05],[1366088400000,48.77],[1366174800000,47.65],[1366261200000,46.81],[1366347600000,47.68],[1366606800000,47.98],[1366693200000,48.67],[1366779600000,48.94],[1366866000000,48.9],[1366952400000,48.1],[1367211600000,48.29],[1367298000000,48.91],[1367384400000,48.35],[1367470800000,48.72],[1367557200000,49.26],[1367816400000,49.4],[1367902800000,49.31],[1367989200000,49.47],[1368075600000,49.11],[1368162000000,49.31],[1368421200000,49.5],[1368507600000,50.22],[1368594000000,50.35],[1368680400000,49.34],[1368766800000,49.66],[1369026000000,49.2],[1369112400000,48.4],[1369198800000,47.9],[1369285200000,47.75],[1369371600000,47.93],[1369717200000,48.09],[1369803600000,47.54],[1369890000000,48.01],[1369976400000,47.34],[1370235600000,47.14],[1370322000000,46.19],[1370408400000,45.59],[1370494800000,45.95],[1370581200000,46.46],[1370840400000,46.49],[1370926800000,45.51],[1371013200000,45.64],[1371099600000,46.44],[1371186000000,46.18],[1371445200000,46.83],[1371531600000,47.1],[1371618000000,46.27],[1371704400000,45.29],[1371790800000,45.4],[1372050000000,44.77],[1372136400000,45.05],[1372222800000,45.64],[1372309200000,46.26],[1372395600000,45.92],[1372654800000,46.54],[1372741200000,46.33],[1372827600000,46.32],[1373000400000,46.64],[1373259600000,47.4],[1373346000000,48.1],[1373432400000,48.51],[1373518800000,48.83],[1373605200000,49.18],[1373864400000,49.4],[1373950800000,48.98],[1374037200000,49.04],[1374123600000,49.62],[13742100! 00000,49..55],[1374469200000,50],[1374555600000,49.52],[1374642000000,48.68],[1374728400000,48.89],[1374814800000,49.12],[1375074000000,49.1],[1375160400000,48.93],[1375246800000,49.01],[1375333200000,49.92],[1375419600000,49.74],[1375678800000,49.12],[1375765200000,48.75],[1375851600000,48.55],[1375938000000,48.73],[1376024400000,48.66],[1376283600000,48.53],[1376370000000,48.75],[1376456400000,48.9],[1376542800000,47.75],[1376629200000,47.76],[1376888400000,47.19],[1376974800000,47.49],[1377061200000,47.1],[1377147600000,47.53],[1377234000000,47.38],[1377493200000,46.91],[1377579600000,46.26],[1377666000000,45.98],[1377752400000,46.2],[1377838800000,45.68],[1378184400000,45.8],[1378270800000,46],[1378357200000,46.02],[1378443600000,45.59],[1378702800000,46.25],[1378789200000,46.62],[1378875600000,46.5],[1378962000000,46.3],[1379048400000,46.56],[1379307600000,46.77],[1379394000000,46.75],[1379480400000,47.2],[1379566800000,47.38],[1379653200000,47.44],[1379912400000,47.02],[1379998800000,47.01],[1380085200000,47.14],[1380171600000,47.25],[1380258000000,47.46],[1380517200000,47.16],[1380603600000,47.3],[1380690000000,47.55],[1380776400000,47.06],[1380862800000,47.63],[1381122000000,47.5],[1381208400000,47.13],[1381294800000,47.11],[1381381200000,48.46],[1381467600000,48.56],[1381726800000,48.99],[1381813200000,48.67],[1381899600000,49.46],[1381986000000,49.86],[1382072400000,49.99],[1382331600000,49.95],[1382418000000,50.33],[1382504400000,50.13],[1382590800000,50.32],[1382677200000,50.18],[1382936400000,50.3],[1383022800000,50.63],[1383109200000,50.56],[1383195600000,50.05],[1383282000000,50],[1383544800000,49.91],[1383631200000,49.67],[1383717600000,50.24],[1383804000000,49.62],[1383890400000,50.57],[1384149600000,50.59],[1384236000000,50.12],[1384322400000,50.52],[1384408800000,50.89],[1384495200000,51.08],[1384754400000,50.9],[1384840800000,51.13],[1384927200000,50.94],[1385013600000,51.91],[1385100000000,52.41],[1385359200000,52.66],[1385445600000,52.69],[1385532000000,52.95],[1385704800000,52.41]! ,[13859640! 00000,52.15],[1386050400000,51.86],[1386136800000,51.68],[1386223200000,51.39],[1386309600000,52.28],[1386568800000,52.24],[1386655200000,52.02],[1386741600000,51.39],[1386828000000,51.33],[1386914400000,51.22],[1387173600000,50.83],[1387260000000,50.67],[1387346400000,51.52],[1387432800000,51.4],[1387519200000,52.01],[1387778400000,52.05],[1387864800000,52.22],[1388037600000,52.38],[1388124000000,51.98],[1388383200000,52.25],[1388469600000,52.37],[1388642400000,51.45],[1388728800000,51.13],[1388988000000,51],[1389074400000,51.05],[1389160800000,50.89],[1389247200000,51.11],[1389333600000,51.15],[1389592800000,50.51],[1389679200000,50.8],[1389765600000,50.87],[1389852000000,50.51],[1389938400000,50.52],[1390284000000,50.48],[1390370400000,50.7],[1390456800000,50.14],[1390543200000,48.81],[1390802400000,48.77],[1390888800000,49.26],[1390975200000,48.61],[1391061600000,49.23],[1391148000000,48.45],[1391407200000,47.61],[1391493600000,47.25],[1391580000000,47.1],[1391666400000,45.21],[1391752800000,45.73],[1392012000000,45.78],[1392098400000,46.32],[1392184800000,46.51],[1392271200000,46.92],[139235760

47.18 (1y: +0%) $(function(){var seriesOptions=[],yAxisOptions=[],name='CINF',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1363323600000,46.98],[1363582800000,46.17],[1363669200000,46.18],[1363755600000,46.51],[1363842000000,46.2],[1363928400000,46.36],[1364187600000,46.41],[1364274000000,46.95],[1364360400000,46.89],[1364446800000,47.22],[1364792400000,47.12],[1364878800000,47.53],[1364965200000,47.43],[1365051600000,47.55],[1365138000000,47.36],[1365397200000,47.79],[1365483600000,47.66],[1365570000000,48.36],[1365656400000,49.03],[1365742800000,48.8],[1366002000000,48.05],[1366088400000,48.77],[1366174800000,47.65],[1366261200000,46.81],[1366347600000,47.68],[1366606800000,47.98],[1366693200000,48.67],[1366779600000,48.94],[1366866000000,48.9],[1366952400000,48.1],[1367211600000,48.29],[1367298000000,48.91],[1367384400000,48.35],[1367470800000,48.72],[1367557200000,49.26],[1367816400000,49.4],[1367902800000,49.31],[1367989200000,49.47],[1368075600000,49.11],[1368162000000,49.31],[1368421200000,49.5],[1368507600000,50.22],[1368594000000,50.35],[1368680400000,49.34],[1368766800000,49.66],[1369026000000,49.2],[1369112400000,48.4],[1369198800000,47.9],[1369285200000,47.75],[1369371600000,47.93],[1369717200000,48.09],[1369803600000,47.54],[1369890000000,48.01],[1369976400000,47.34],[1370235600000,47.14],[1370322000000,46.19],[1370408400000,45.59],[1370494800000,45.95],[1370581200000,46.46],[1370840400000,46.49],[1370926800000,45.51],[1371013200000,45.64],[1371099600000,46.44],[1371186000000,46.18],[1371445200000,46.83],[1371531600000,47.1],[1371618000000,46.27],[1371704400000,45.29],[1371790800000,45.4],[1372050000000,44.77],[1372136400000,45.05],[1372222800000,45.64],[1372309200000,46.26],[1372395600000,45.92],[1372654800000,46.54],[1372741200000,46.33],[1372827600000,46.32],[1373000400000,46.64],[1373259600000,47.4],[1373346000000,48.1],[1373432400000,48.51],[1373518800000,48.83],[1373605200000,49.18],[1373864400000,49.4],[1373950800000,48.98],[1374037200000,49.04],[1374123600000,49.62],[13742100! 00000,49..55],[1374469200000,50],[1374555600000,49.52],[1374642000000,48.68],[1374728400000,48.89],[1374814800000,49.12],[1375074000000,49.1],[1375160400000,48.93],[1375246800000,49.01],[1375333200000,49.92],[1375419600000,49.74],[1375678800000,49.12],[1375765200000,48.75],[1375851600000,48.55],[1375938000000,48.73],[1376024400000,48.66],[1376283600000,48.53],[1376370000000,48.75],[1376456400000,48.9],[1376542800000,47.75],[1376629200000,47.76],[1376888400000,47.19],[1376974800000,47.49],[1377061200000,47.1],[1377147600000,47.53],[1377234000000,47.38],[1377493200000,46.91],[1377579600000,46.26],[1377666000000,45.98],[1377752400000,46.2],[1377838800000,45.68],[1378184400000,45.8],[1378270800000,46],[1378357200000,46.02],[1378443600000,45.59],[1378702800000,46.25],[1378789200000,46.62],[1378875600000,46.5],[1378962000000,46.3],[1379048400000,46.56],[1379307600000,46.77],[1379394000000,46.75],[1379480400000,47.2],[1379566800000,47.38],[1379653200000,47.44],[1379912400000,47.02],[1379998800000,47.01],[1380085200000,47.14],[1380171600000,47.25],[1380258000000,47.46],[1380517200000,47.16],[1380603600000,47.3],[1380690000000,47.55],[1380776400000,47.06],[1380862800000,47.63],[1381122000000,47.5],[1381208400000,47.13],[1381294800000,47.11],[1381381200000,48.46],[1381467600000,48.56],[1381726800000,48.99],[1381813200000,48.67],[1381899600000,49.46],[1381986000000,49.86],[1382072400000,49.99],[1382331600000,49.95],[1382418000000,50.33],[1382504400000,50.13],[1382590800000,50.32],[1382677200000,50.18],[1382936400000,50.3],[1383022800000,50.63],[1383109200000,50.56],[1383195600000,50.05],[1383282000000,50],[1383544800000,49.91],[1383631200000,49.67],[1383717600000,50.24],[1383804000000,49.62],[1383890400000,50.57],[1384149600000,50.59],[1384236000000,50.12],[1384322400000,50.52],[1384408800000,50.89],[1384495200000,51.08],[1384754400000,50.9],[1384840800000,51.13],[1384927200000,50.94],[1385013600000,51.91],[1385100000000,52.41],[1385359200000,52.66],[1385445600000,52.69],[1385532000000,52.95],[1385704800000,52.41]! ,[13859640! 00000,52.15],[1386050400000,51.86],[1386136800000,51.68],[1386223200000,51.39],[1386309600000,52.28],[1386568800000,52.24],[1386655200000,52.02],[1386741600000,51.39],[1386828000000,51.33],[1386914400000,51.22],[1387173600000,50.83],[1387260000000,50.67],[1387346400000,51.52],[1387432800000,51.4],[1387519200000,52.01],[1387778400000,52.05],[1387864800000,52.22],[1388037600000,52.38],[1388124000000,51.98],[1388383200000,52.25],[1388469600000,52.37],[1388642400000,51.45],[1388728800000,51.13],[1388988000000,51],[1389074400000,51.05],[1389160800000,50.89],[1389247200000,51.11],[1389333600000,51.15],[1389592800000,50.51],[1389679200000,50.8],[1389765600000,50.87],[1389852000000,50.51],[1389938400000,50.52],[1390284000000,50.48],[1390370400000,50.7],[1390456800000,50.14],[1390543200000,48.81],[1390802400000,48.77],[1390888800000,49.26],[1390975200000,48.61],[1391061600000,49.23],[1391148000000,48.45],[1391407200000,47.61],[1391493600000,47.25],[1391580000000,47.1],[1391666400000,45.21],[1391752800000,45.73],[1392012000000,45.78],[1392098400000,46.32],[1392184800000,46.51],[1392271200000,46.92],[139235760

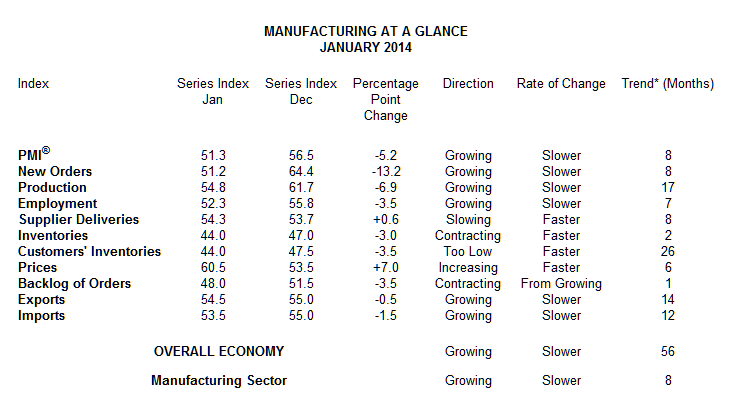

Source: ISM

Source: ISM