BALTIMORE (Stockpickr) -- The Fed is shutting the tap this week, ending the QE3 bond-.buying program that's arguably been one of the biggest structural drivers of the rally in stocks over the past couple of years. Or at least that's the plan.

Must Read: Warren Buffett's Top 10 Dividend Stocks

While the Fed's press release calls for an end to quantitative easing, this isn't the first time they've called an end to the buying spree before starting another one. With key data, such as forward inflation lower than it's been since Operation Twist in 2011, the possibility of QE4 (or QE5, depending on how you've been counting) is becoming more palpable by the day.

So far, stocks have had a pretty tepid reaction to the end of QE3. The decision was largely already baked into stock prices. As I write, there are some big-name trades that are starting to look very attractive as a result. Today, we're taking a technical look at five large-cap stocks worth trading this week.

First, a little on the technical toolbox we're using here. Technicals are a study of the market itself. Since the market is ultimately the only mechanism that determines a stock's price, technical analysis is a valuable tool even in the roughest of trading conditions. Technical charts are used every day by proprietary trading floors, Wall Street's biggest financial firms, and individual investors to get an edge on the market. And research shows that skilled technical traders can bank gains as much as 90% of the time.

Every week, I take an in-depth look at big names that are telling important technical stories. Here's this week's look at five big stocks to trade this week.

Must Read: How to Trade the Market's Most-Active Stocks

Capital One Financial

Up first is big banking company Capital One Financial (COF). Capital One has been in rally mode for much of the year, climbing more than 18% since the beginning of February. And while shares have been churning sideways for the last few months, that range-bound price action is the exact reason that COF looks tradable here.

COF has been consolidating sideways for the last few months, bouncing around in a rectangle pattern. The rectangle setup is formed by a pair of horizontal resistance and support levels that basically "box in" shares between $85 and $77.50. Consolidations such as the one in Capital One are common after big moves (like the one that started in February); they give the stock a chance to bleed off momentum as buyers and sellers figure out their next move.

Don't get thrown by the bear trap in COF. It was a false breakdown. The bullish divergence with momentum was a tip-off that the drop wouldn't hold.

From here, a breakout above $85 is the next buy signal on the way up -- a violation of support at $77.50 means more downside suddenly looks likely. Because Capital One's prior trend before it entered the rectangle was higher, a move through $85 looks like the more likely outcome for this stock.

Must Read: 5 Stocks Insiders Love Right Now

Bank of Ireland

Bank of Ireland (IRE) may be a lot smaller than Capital One, but its positioning as one of the biggest banks in Ireland gives this $13 billion firm considerable significance -- and trading volume. Bank of Ireland has been selling off for most of 2014, but buyers could be in for a reprieve this fall. That's because IRE is currently forming a long-term reversal pattern called a "double bottom."

The double bottom in IRE looks just like it sounds. The setup is formed by a pair of swing lows that bottom out at approximately the same price level. The buy signal comes on a push above $17, the price peak that separates those two lows in IRE. Shares are pointed lower this morning in reaction to the dollar rally that got kicked off by the Fed's QE3 announcement, but that move isn't technically significant as long as IRE stays above $13.50.

Meanwhile, the side indicator in the IRE trade is momentum, measured by 14-day RSI. Momentum has been making higher lows, even as shares hit the same lows in price – that's a bullish indication that buying pressure is building in this stock. Even so, don't be a buyer until $17 gets taken out; that's still a meaningful price barrier at this time.

Must Read: 10 Stocks George Soros Is Buying

Discover Financial Services

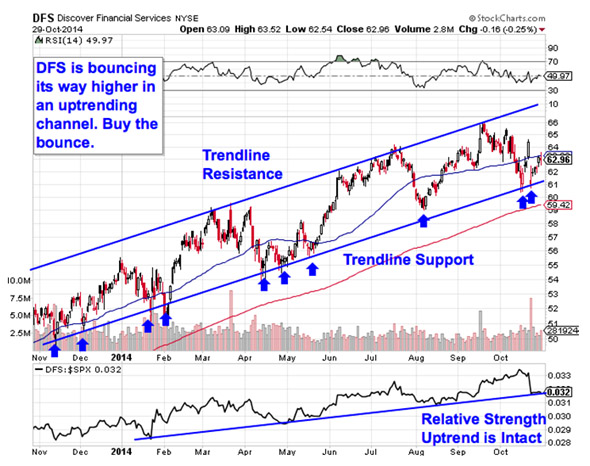

The financial sector is getting a lot of attention on today's list, and our next trade setup is no exception; we're looking at Discover Financial Services' (DFS) chart next. The good news is that you don't need to be an expert technical trader to figure out what's going on in shares of DFS. This setup is about as basic as it gets.

Discover has been bouncing its way higher in a well-defined uptrending channel for the better part of the last year now. That channel is formed by a pair of parallel trend line support and resistance levels that identify the high-probability range for shares to stay within. Put more simply, every touch of trend line support in 2014 has been an extremely low-risk opportunity to get into shares of DFS, and we're touching that level for a tenth time this week. It makes sense to buy this bounce off of support.

Waiting for a bounce off of support is a critical test for two big reasons: It's the spot where shares have the furthest to move up before they hit resistance, and it's the spot where the risk is the least (because shares have the least room to move lower before you know you're wrong). Remember, all trend lines do eventually break, but by actually waiting for the bounce to happen first, you're ensuring DFS can actually still catch a bid along that line before you put your money on shares.

Relative strength adds some confidence to that call. The relative strength line at the bottom of Discover's chart has been in a textbook uptrend since the end of last year. As long as that uptrend remains intact, DFS should keep outperforming the rest of the market.

Must Read: 5 Rocket Stocks to Buy for November Gains

Charter Communications

Charter Communications (CHTR) has been a name to own in 2014: since the calendar flipped over to January, shares of this $17 billion cable company have rallied more than 12%. That's nearly double what the S&P 500 has managed to accomplish over that same stretch. But don't worry if you missed the move. CHTR looks ready to kick off another leg higher this fall. Here's how to trade it.

CHTR is in the early stages of forming an inverse head and shoulders setup, a bullish reversal pattern that indicates exhaustion among sellers. You can spot the inverse head and shoulders by looking for two swing lows that bottom out around the same level (the shoulders), separated by a bigger trough called the head; the buy signal comes on the breakout above the pattern's "neckline" level (that's the $164 price level here).

Even though the right shoulder hasn't formed yet, any close above $164 from here is a buy signal in Charter.

Must Read: 5 Hated Earnings Stocks You Should Love

Philip Morris International

Last up is Philip Morris International (PM), a name that we first looked at a couple of weeks ago. At the time, PM was forming a bullish ascending triangle pattern, and the buy signal came on a breakout through $85. Since then, shares have moved up near our $89.50 price target – and PM is starting to look ready for a secondary breakout.

If shares can catch a bid above their previous high at $89.50, then we've got another big buy signal in this tobacco giant.

Why all of that significance at that $89.59 level? It all comes down to buyers and sellers. Price patterns like the ascending triangle are a good quick way to identify what's going on in the price action, but they're not the actual reason a stock is tradable. Instead, the "why" comes down to basic supply and demand for PM's stock.

The $89.50 resistance level is a price where there has been an excess of supply of shares; in other words, it's a spot where sellers have previously been more eager to step in and take gains than buyers have been to buy. That's what makes a breakout above $89.50 so significant. The move means that buyers are finally strong enough to absorb all of the excess supply above that price level.

Expect some downside today thanks to the dollar rally (PM is sensitive to upside in the dollar because it earns revenues in foreign currencies but reports in dollars), but $89.50 is the line in the sand to watch next. If you bought the $85 breakout, I'd recommend ratcheting your stop loss up to the 50-day moving average.

To see this week's trades in action, check out the Must-See Charts portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

Must Read: 10 Stocks Billionaire John Paulson Loves in 2014

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in the names mentioned.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to

TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation.Follow Jonas on Twitter @JonasElmerraji

Paul Sakuma

Paul Sakuma

Related BZSUM Mid-Morning Market Update: Markets Flat; Ford Posts Upbeat Profit #PreMarket Primer: Friday, October 24: Ebola Fears Weigh On Markets

Related BZSUM Mid-Morning Market Update: Markets Flat; Ford Posts Upbeat Profit #PreMarket Primer: Friday, October 24: Ebola Fears Weigh On Markets

) is set to trade ex-dividend on October 29. The automobile company offers a dividend yield of 3.54% based on Wednesday's closing price of $14.13 and the company's quarterly dividend payout of 12.5 cents. The stock is down 8% year-to-date. Dividend.com currently rates F as “Neutral” with a DARS™ rating of 3.4 stars out of 5 stars.

) is set to trade ex-dividend on October 29. The automobile company offers a dividend yield of 3.54% based on Wednesday's closing price of $14.13 and the company's quarterly dividend payout of 12.5 cents. The stock is down 8% year-to-date. Dividend.com currently rates F as “Neutral” with a DARS™ rating of 3.4 stars out of 5 stars.

Patients shun Dallas hospital hit by Ebola NEW YORK (CNNMoney) The mandatory Ebola-related quarantine is over, but Dr. Nancy Snyderman and the crew members who traveled to Liberia with her are not coming back to work yet.

Patients shun Dallas hospital hit by Ebola NEW YORK (CNNMoney) The mandatory Ebola-related quarantine is over, but Dr. Nancy Snyderman and the crew members who traveled to Liberia with her are not coming back to work yet.

Melinda Gates on Ebola: 'Vast inequities'

Melinda Gates on Ebola: 'Vast inequities'  www.starbucks.com These are hard times for the soft drink industry, but no one seems to be telling Starbucks (SBUX). The java giant introduced Fizzio this summer, serving up three flavors of handcrafted carbonated beverages. It's an odd time for Starbucks to be rolling out new soft drinks. Consumption in this country is waning. We saw that earlier this month when PepsiCo (PEP) posted quarterly results that were more flat than fizzy, with carbonated-soft-drink volume declining 1.5 percent in North America compared to the same period a year earlier. The Pepsi provider saw soda sales in North America slip 2 percent the quarter before that. We also saw that on Tuesday morning when Coca-Cola (KO) reported fresh financial results. Sparkling-beverage sales in North America declined by 1 percent, and that was with the company gaining market share on the heels of the relatively successful Share a Coke campaign, in which cans and bottles were emblazoned with names and terms of endearment. (Star)Bucking the Trend The world's two largest pop stars are faltering when it comes to carbonated drinks in this country, and they're not alone. Industry trade watcher Beverage Digest reports that overall soda volumes have fallen for nine years in a row. Sales plunged 3 percent in 2013, with diet sodas suffering an even bigger decline. Starbucks can always suggest that its foray into premium soft drinks is about more than what the masses are sipping. It's focusing on high-end root beer, ginger ale and lemon sodas that are made at the store just as they are ordered. Baristas mix up all-natural ingredients. The spiced root beer soda, for example, combines cane sugar, cinnamon, nutmeg, clove and star anise to flavor carbonated water. It's made with the same handcrafted detail and human theater as Starbucks' signature brews. The early results have been encouraging, and not just because it gives Starbucks yet another product line to sell. "Consumer response to Fizzio has been strong," Starbucks noted in July's conference call, pointing out that after introducing it through 3,000 stores in the Sun Belt a month earlier, successful tests in Japan and Singapore mean Fizzio will be added to select international markets in the coming quarters. It's not just about giving non-coffee drinkers something to do while their friends are sipping on their vanilla lattes and mocha cappuccinos. Starbucks hopes that these handcrafted beverages will attract customers during the afternoons and evenings, when things typically slow down for their coffee orders. It is also hoping that it results in a spike in food orders to go alongside the refreshing beverages. A Latte Potential Starbucks is trying to do for soda what it did for premium coffee. Starbucks was inspired by the artsy European coffeehouses, but it was ultimately about taking a throwaway morning beverage that consumers associated with greasy-spoon diners or caffeinated fuel to accompany the morning drudgery and transforming it into an aspirational product. It worked, of course. Starbucks serves 70 million customers a week through its growing empire that currently consists of 21,000 stores in 65 countries. It doesn't matter if soda sales have been slumping for years. Coffee wasn't very exciting until Starbucks made bean-water fashionable. Growing Fizzio's success both here and abroad won't be easy at a time when the fizz has gone flat for the carbonated beverage industry, but Starbucks knows a thing or two about turning a tired drink category into something that's relevant again. Coca-Cola and PepsiCo had better hope that Starbucks succeeds, because clearly they can't turn things around on their own. More from Rick Aristotle Munarriz

www.starbucks.com These are hard times for the soft drink industry, but no one seems to be telling Starbucks (SBUX). The java giant introduced Fizzio this summer, serving up three flavors of handcrafted carbonated beverages. It's an odd time for Starbucks to be rolling out new soft drinks. Consumption in this country is waning. We saw that earlier this month when PepsiCo (PEP) posted quarterly results that were more flat than fizzy, with carbonated-soft-drink volume declining 1.5 percent in North America compared to the same period a year earlier. The Pepsi provider saw soda sales in North America slip 2 percent the quarter before that. We also saw that on Tuesday morning when Coca-Cola (KO) reported fresh financial results. Sparkling-beverage sales in North America declined by 1 percent, and that was with the company gaining market share on the heels of the relatively successful Share a Coke campaign, in which cans and bottles were emblazoned with names and terms of endearment. (Star)Bucking the Trend The world's two largest pop stars are faltering when it comes to carbonated drinks in this country, and they're not alone. Industry trade watcher Beverage Digest reports that overall soda volumes have fallen for nine years in a row. Sales plunged 3 percent in 2013, with diet sodas suffering an even bigger decline. Starbucks can always suggest that its foray into premium soft drinks is about more than what the masses are sipping. It's focusing on high-end root beer, ginger ale and lemon sodas that are made at the store just as they are ordered. Baristas mix up all-natural ingredients. The spiced root beer soda, for example, combines cane sugar, cinnamon, nutmeg, clove and star anise to flavor carbonated water. It's made with the same handcrafted detail and human theater as Starbucks' signature brews. The early results have been encouraging, and not just because it gives Starbucks yet another product line to sell. "Consumer response to Fizzio has been strong," Starbucks noted in July's conference call, pointing out that after introducing it through 3,000 stores in the Sun Belt a month earlier, successful tests in Japan and Singapore mean Fizzio will be added to select international markets in the coming quarters. It's not just about giving non-coffee drinkers something to do while their friends are sipping on their vanilla lattes and mocha cappuccinos. Starbucks hopes that these handcrafted beverages will attract customers during the afternoons and evenings, when things typically slow down for their coffee orders. It is also hoping that it results in a spike in food orders to go alongside the refreshing beverages. A Latte Potential Starbucks is trying to do for soda what it did for premium coffee. Starbucks was inspired by the artsy European coffeehouses, but it was ultimately about taking a throwaway morning beverage that consumers associated with greasy-spoon diners or caffeinated fuel to accompany the morning drudgery and transforming it into an aspirational product. It worked, of course. Starbucks serves 70 million customers a week through its growing empire that currently consists of 21,000 stores in 65 countries. It doesn't matter if soda sales have been slumping for years. Coffee wasn't very exciting until Starbucks made bean-water fashionable. Growing Fizzio's success both here and abroad won't be easy at a time when the fizz has gone flat for the carbonated beverage industry, but Starbucks knows a thing or two about turning a tired drink category into something that's relevant again. Coca-Cola and PepsiCo had better hope that Starbucks succeeds, because clearly they can't turn things around on their own. More from Rick Aristotle Munarriz