After hitting a lifetime high of 11,171 in January, the Nifty corrected sharply to break the 10,000-mark in March. It followed it up with a gradual recovery along with rangebound trade. Trade war tensions between US and China, sharp rupee depreciation versus the dollar, steep increase in crude oil prices along with Karnataka election verdict caused selling pressure as well as volatility in the market.

Now the market has taken all these concerns in its strides and started inching towards that record high again on hopes of an earnings recovery and economic growth this fiscal. Stability in the dollar-rupee and crude oil prices aided the rally, though trade tensions took centre stage after the US threatened 10 percent tariffs on $200 billion of Chinese goods.

The Nifty is now trading at a 5-month high of around 11,000 levels and is 150-point away from its earlier record high. The market recovery has been backed by domestic inflows when foreign investors were sellers. The market is likely to continue its upward trajectory, though there could be some volatility due to global cues like trade tensions and any sharp spike in crude oil prices, experts said.

"We expect Indian markets to grind higher, though volatility will remain high. This may induce swings in either direction," Karvy Stock Broking said in its recent note. It sees valuations at more reasonable levels now (compared to January) with Nifty trading at a 12-month forward price-to-earnings ratio of 18 times (Nifty's average has been 16.2 times since 2005). ��At current levels, valuations are not a constraint for the markets to move higher.��

related news Sensex at record high: Sectors which Sundaram Asset Management is betting on 1 largecap, 2 midcaps that could return 7-17 percent return in 6 months

Experts too see limited downside to the market now. For a correction to occur, the stated that oil prices have to stay above $80 a barrel and dollar has to increase sharply against the rupee.

But Pratik Gupta of Deutsche Bank India expects volatility to continue in the short term. ��The market could fall 3-5 percent only if there is a sharp appreciation in the dollar-rupee and crude oil prices spike.��

However, he was quick to counter that this does not mean the upside is unlikely. ��The Sensex and Nifty can end the current calendar year at 37,000 and 11,400, respectively, as the structural growth story is intact for the next 3-5 years with corporate earnings picking up.��

Karvy's year-end target for the Sensex is 37,500, which is 6 percent higher than current levels. "We believe the Sensex will touch 40,500 by December 2020, an upside of 14 percent from the current levels."

The research house suggests investors keep an eye on the dollar-rupee, global trade war, oil prices, ongoing resolution of bad loans in the banking sector and state elections in 4 states (Mizoram, Rajasthan, Chhattisgarh and Madhya Pradesh) in the run-up to the general elections to be held in May 2019.

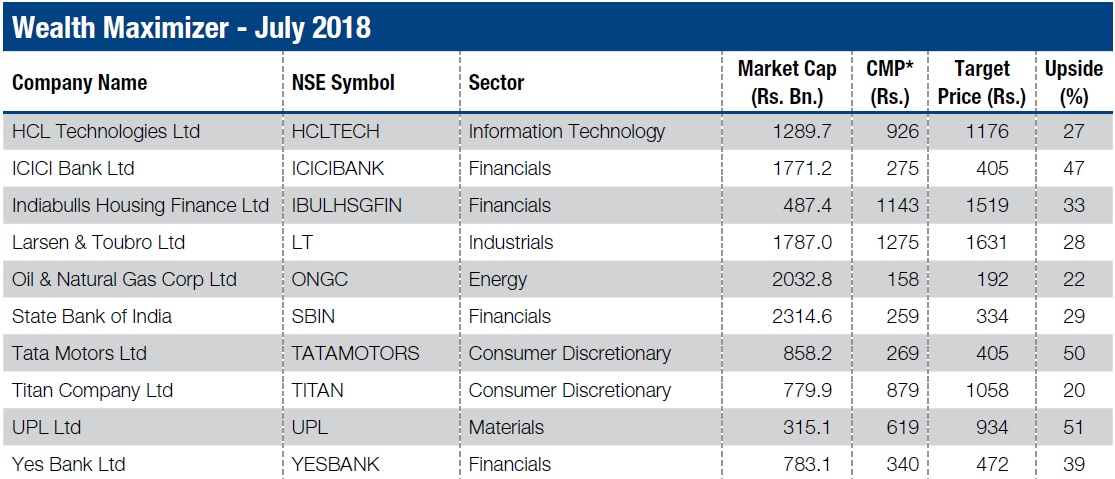

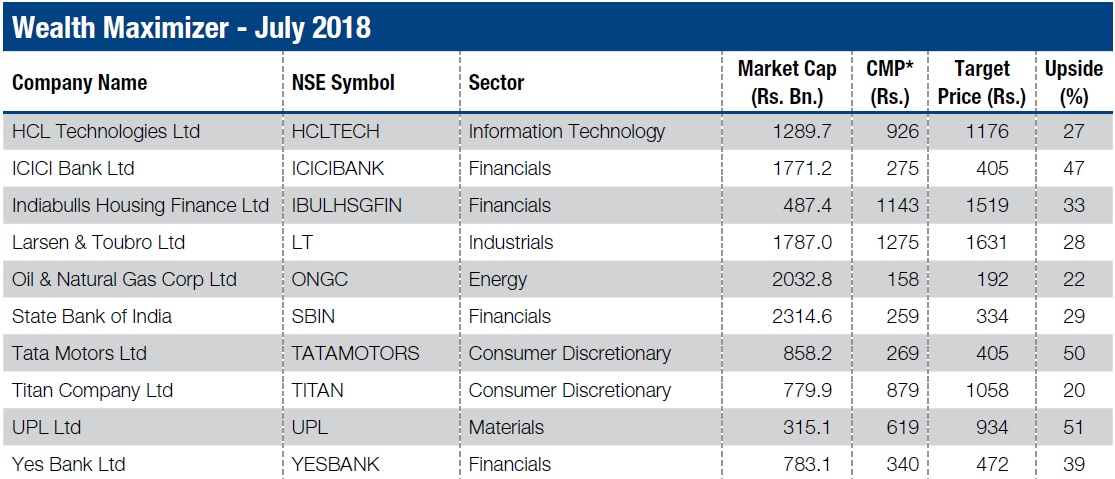

Here is the list of 10 stocks from Karvy Stock Broking that can deliver 22-50 percent return in 1 year:

HCL Technologies: Buy | Target - Rs 1,176 | Return - 27 percent

The FY19 guidance of 5.25 percent organic growth was slightly below estimates and lower than industry average. This led to a sharp correction in the stock. HCLT��s underperformance relative to both broader markets and IT index is overdone. HCLT is likely to surprise positively on the growth front.

On a TTM basis, HCLT is currently trading at a PE of 14.8 and FY20E PE of 12.5. Currently, HCLT is trading at a discount of 46 percent to TCS��s PE vs historical average of 25 percent.

We remain constructive on the stock given industry leading growth rate and stable margins. We value HCLT at FY20 PE of 15.8 and reiterate Buy with a target of Rs 1176, an upside of 27 percent.

Sustained weakness in IMS and margin risk due to higher investments are key downside risks.

ICICI Bank: Buy | Target - Rs 405 | Return - 47 percent

Even though the slippages increased in Q4FY17, the material portion that includes adversely classified accounts including the guided stress list remained unchanged.

This is positive for the company as we expect the bank to be left with the adversely classified exposure of Rs 13,330 crore of which we assess Rs 10,000 crore to slip in FY19E.

Also, the RBI review report didn��t impact the asset quality negatively.

We estimate return on assets (RoAs) to improve to around 1.7 percent in FY20E from around 0.9 percent in FY18. We maintain a Buy on the stock with target price of Rs 405 valuing core banking operations at Rs 300, 1.9x FY19E P/B and subsidiaries at Rs 105 per share.

Key risk could be discovery of new NPAs that can further deteriorate bank��s financials, thus making recovery difficult.

Indiabulls Housing Finance: Buy | Target - Rs 1,519 | Return - 33 percent

The company fundamentals are on strong footing and as per consensus, the operating performance will be strong which derives a valuation of 3.4x price/book value for a target price of Rs 1,519 representing an upside potential of 33 percent.

Larsen & Toubro: Buy | Target - Rs 1,631 | Return - 28 percent

L&T's exposure to various sectors/ geographies coupled with its excellent execution capabilities and its balance sheet strength compared to other peers in the sector has resulted in strong order book build up.

The consensus values the company at 24.0x for a target price of Rs 1,631, representing an upside potential of 28 percent. Delay in capex cycle recovery & order execution may pose threat to the call.

Oil & Gas Natural Gas Corporation: Buy | Target - Rs 192 | Return - 22 percent

Synergies in ONGC's business and likely consolidation in downstream business with merger of HPCL and MRPL will ensure uptick in growth for the company.

We have valued the stock at PE 8x of FY20E EPS and have arrived at a target price of Rs 192 which gives potential upside of 22 percent. However, subsidy sharing will be detrimental to ONGC's performance.

State Bank of India: Buy | Target - Rs 334 | Return - 29 percent

SBI with its focus on loan book growth, CASA share in deposits, sustained NIMs of 2.7 percent, reducing non-performing assets (NPAs) and fresh slippages augur well in the long term.

Merged SBI presents a case for a diversified balance sheet that mirrors the domestic economy available at bargain valuations from a long term investment perspective.

We value the stock at 1.2x FY20 BVPS with a Buy rating for a target price of Rs 334.

Tata Motors: Buy | Target - Rs 405 | Return - 50 percent

Around GBP 13.5 billion has been lined up for investments for the next three years on technology, new launches and capacity expansion which works out to be around GBP 4.5 billion per annum out of which around 78 percent is expected to be spent on technology and product development.

The technology involved is called Modular Longitudinal Architecture (MLA) which is compatible with Internal Combustion Engine (ICE), Battery Electric Vehicle (BEV) and Plug-in Hybrid Electric Vehicle (PHEV) making it a flexible design. This is expected to bring about some operational benefits and will be fully implemented by FY25E.

The Bloomberg consensus target price for Tata Motors is Rs 405 which is valued at P/E 8.9x for FY20E EPS based on future growth prospects. However, slowdown in the UK and European markets for JLR can be viewed as the possible downside risks to the call.

Titan Company: Buy | Target - Rs 1,058 | Return - 20 percent

Under jewellery segment, 'Tanishq' is the most successful and leading brand for the company in India. Now the company is planning to enter into international markets in jewellery segment by the end of FY19.

Titan, with its improving operational efficiencies and expansion strategies in retail network, is moving up the value chain and capturing more market share.

The stock is valued at 52.0x on Bloomberg consensus FY20E EPS with Buy rating to arrive at target price of Rs 1,058 with an upside of 20 percent.

However, government regulations on gold purchases, competition from regional jewellery players, gold price volatility, revival in consumer spending & competition from e-commerce players will be the key risks to the earning of the company.

UPL: Buy | Target - Rs 934 | Return - 51 percent

The favorable weather forecasts for key agricultural regions, constructive government policies, and possibility of price increase (given stock-to-use ratios of key grain commodities expected to fall in certain regions) should speak well.

Crop diversity and gaining traction in biological nutrition portfolio will further drive growth for UPL and help in mitigating risk. We recommend Buy for a target of Rs 934 valuing at 17.4x FY20E EPS representing an upside potential of 51 percent.

Yes Bank: Buy | Target - Rs 472 | Return - 39 percent

Volatility in asset quality is a cause of concern.

In the past five years, the bank has consistently delivered 1.5 percent+ return on assets and 18 percent+ return on equity. Liabilities have been managed well with CASA as well as retail deposits improving and its target of 40 percent by FY19 looks achievable.

It has ambitious target for NIM of 4 percent by FY20. Expansion of branches and employee addition will keep costs elevated.

Supported by strong earnings and the ability to raise capital at a good price, its book value accretion has been the strongest among peers with a five-year CAGR of +30 percent. We maintain a Buy on the stock with target price of Rs 472, an upside of 39 percent.

Disclaimer: The views and investment tips expressed by brokerage house on Moneycontrol are its own, and not that of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions. First Published on Jul 12, 2018 11:10 am

Hub Group (NASDAQ:HUBG)‘s stock had its “hold” rating reissued by analysts at Cowen in a research note issued on Thursday. They currently have a $53.00 price objective on the transportation company’s stock. Cowen’s price target would indicate a potential upside of 0.57% from the company’s current price.

CF Industries (NYSE:CF) released its quarterly earnings results on Wednesday. The basic materials company reported $0.63 EPS for the quarter, topping the Zacks’ consensus estimate of $0.42 by $0.21, Briefing.com reports. The company had revenue of $1.30 billion for the quarter, compared to analyst estimates of $1.21 billion. CF Industries had a negative return on equity of 0.11% and a net margin of 10.96%. CF Industries’s revenue was up 15.7% compared to the same quarter last year. During the same quarter last year, the firm posted $0.10 earnings per share.

CF Industries (NYSE:CF) released its quarterly earnings results on Wednesday. The basic materials company reported $0.63 EPS for the quarter, topping the Zacks’ consensus estimate of $0.42 by $0.21, Briefing.com reports. The company had revenue of $1.30 billion for the quarter, compared to analyst estimates of $1.21 billion. CF Industries had a negative return on equity of 0.11% and a net margin of 10.96%. CF Industries’s revenue was up 15.7% compared to the same quarter last year. During the same quarter last year, the firm posted $0.10 earnings per share.  William Patalon III

William Patalon III BRITISH AMERICAN TOBACCO PLC ADS Common Stock (LON:BATS) insider Alan Davy bought 39 shares of the company’s stock in a transaction on Monday, July 9th. The shares were acquired at an average price of GBX 3,931 ($52.34) per share, with a total value of 拢1,533.09 ($2,041.13).

BRITISH AMERICAN TOBACCO PLC ADS Common Stock (LON:BATS) insider Alan Davy bought 39 shares of the company’s stock in a transaction on Monday, July 9th. The shares were acquired at an average price of GBX 3,931 ($52.34) per share, with a total value of 拢1,533.09 ($2,041.13).

Post to FacebookPosted!

Post to FacebookPosted! During the Great Recession, U.S. gross domestic product declined 4.3%. Since then, the economy has rebounded and is now in one of the longest periods of expansion on record. As the economy recovered, the U.S. labor market also began to improve. The unemployment rate dropped from 8.1% in 2012 to 4.4% in 2017, and total employment increased by over five million people. Personal income also grew by 11.2% across the nation in that time frame, while per capita personal income increased by 7.2%. To determine the states where personal incomes are booming, 24/7 Wall St. reviewed total personal income change from the the U.S. Bureau of Economic Analysis. Personal incomes in the 16 states listed here grew by more than the nation��s 11.2% growth rate from 2012 to 2017. AndreyKrav / iStockFullscreen

During the Great Recession, U.S. gross domestic product declined 4.3%. Since then, the economy has rebounded and is now in one of the longest periods of expansion on record. As the economy recovered, the U.S. labor market also began to improve. The unemployment rate dropped from 8.1% in 2012 to 4.4% in 2017, and total employment increased by over five million people. Personal income also grew by 11.2% across the nation in that time frame, while per capita personal income increased by 7.2%. To determine the states where personal incomes are booming, 24/7 Wall St. reviewed total personal income change from the the U.S. Bureau of Economic Analysis. Personal incomes in the 16 states listed here grew by more than the nation��s 11.2% growth rate from 2012 to 2017. AndreyKrav / iStockFullscreen 16. North Carolina: Personal income growth (2012-2017): +12.5%. North Carolina's population grew at a 5.0% pace between 2012 and 2017 as the state attracted nearly 475,000 new residents. With North Carolina's personal income increasing by 12.5% since 2012, financial prosperity may have been a driving factor in migration. ThinkstockFullscreen

16. North Carolina: Personal income growth (2012-2017): +12.5%. North Carolina's population grew at a 5.0% pace between 2012 and 2017 as the state attracted nearly 475,000 new residents. With North Carolina's personal income increasing by 12.5% since 2012, financial prosperity may have been a driving factor in migration. ThinkstockFullscreen 15. Hawaii: Personal income growth (2012-2017): +12.5%. Though Hawaii is often considered a vacation destination, it is also has one of the best job markets in the country. Hawaii's annual unemployment rate of just 2.4% is the lowest in the nation. As more people in the labor force find work, personal income increases. ThinkstockFullscreen

15. Hawaii: Personal income growth (2012-2017): +12.5%. Though Hawaii is often considered a vacation destination, it is also has one of the best job markets in the country. Hawaii's annual unemployment rate of just 2.4% is the lowest in the nation. As more people in the labor force find work, personal income increases. ThinkstockFullscreen 14. Michigan: Personal income growth (2012-2017): +12.6%. Michigan's economy has undergone a significant turnaround in recent years. The state's unemployment improved significantly, dropping from 10.4% in 2011 to 4.6% in 2017. This may be partly behind the state's 12.6% increase in personal income since 2012. ThinkstockFullscreen

14. Michigan: Personal income growth (2012-2017): +12.6%. Michigan's economy has undergone a significant turnaround in recent years. The state's unemployment improved significantly, dropping from 10.4% in 2011 to 4.6% in 2017. This may be partly behind the state's 12.6% increase in personal income since 2012. ThinkstockFullscreen 13. Delaware: Personal income growth (2012-2017): +12.7%. No state has a higher share of workers in the financial sector than Delaware. Some 10.5% of the state's labor force works in the finance sector, a generally high-paying industry. Employment in Delaware's finance industry grew by 5.7% over the last decade, one of the higher growth rates for the industry nationwide. ThinkstockFullscreen

13. Delaware: Personal income growth (2012-2017): +12.7%. No state has a higher share of workers in the financial sector than Delaware. Some 10.5% of the state's labor force works in the finance sector, a generally high-paying industry. Employment in Delaware's finance industry grew by 5.7% over the last decade, one of the higher growth rates for the industry nationwide. ThinkstockFullscreen 12. Tennessee: Personal income growth (2012-2017): +12.8%. Tennessee added over 80,000 professional and business service jobs over the last 10 years, a 25.8% increase. The professional and business service sector is one of the higher-paying industries, and the industry's employment increase likely contributed to the Volunteer State's 12.8% increase in personal income since 2012. f11photo / ThinkstockFullscreen

12. Tennessee: Personal income growth (2012-2017): +12.8%. Tennessee added over 80,000 professional and business service jobs over the last 10 years, a 25.8% increase. The professional and business service sector is one of the higher-paying industries, and the industry's employment increase likely contributed to the Volunteer State's 12.8% increase in personal income since 2012. f11photo / ThinkstockFullscreen 11. South Carolina: Personal income growth (2012-2017): +15.8%. Personal income in South Carolina has grown by 15.8% since 2012, likely because more people in the state have become employed. The unemployment rate declined from 9.2% in 2011 to 4.3% in 2017, one of the steepest drops in the nation. Employment in the state increased by 12.2% over that period, one of the larger increases of any state. ThinkstockFullscreen

11. South Carolina: Personal income growth (2012-2017): +15.8%. Personal income in South Carolina has grown by 15.8% since 2012, likely because more people in the state have become employed. The unemployment rate declined from 9.2% in 2011 to 4.3% in 2017, one of the steepest drops in the nation. Employment in the state increased by 12.2% over that period, one of the larger increases of any state. ThinkstockFullscreen 10. Florida: Personal income growth (2012-2017): +16.2%. As Florida's population has grown more than any state in the country, personal incomes are also growing faster than most other states. A net of over 1.9 million people have migrated to the Sunshine State since 2010, a 10.3% growth rate. Both figures are higher than any other state. ThinkstockFullscreen

10. Florida: Personal income growth (2012-2017): +16.2%. As Florida's population has grown more than any state in the country, personal incomes are also growing faster than most other states. A net of over 1.9 million people have migrated to the Sunshine State since 2010, a 10.3% growth rate. Both figures are higher than any other state. ThinkstockFullscreen 9. Georgia: Personal income growth (2012-2017): +16.6%. Georgia's personal income grew by 16.6% between 2012 and 2017, largely bolstered by the state's trade, transportation, and utilities industry. The sector accounts for 21.1% of all Georgia jobs and employment in the industry has grown 5.3% over the last 10 years. ThinkstockFullscreen

9. Georgia: Personal income growth (2012-2017): +16.6%. Georgia's personal income grew by 16.6% between 2012 and 2017, largely bolstered by the state's trade, transportation, and utilities industry. The sector accounts for 21.1% of all Georgia jobs and employment in the industry has grown 5.3% over the last 10 years. ThinkstockFullscreen 8. California: Personal income growth (2012-2017): +16.6%. As home to Silicon Valley, California is the hub of America's high-paying tech jobs. Employment in California's information industry grew 12.0% over the past decade, a time when the American information industry lost 7.8% of its jobs. Though it accounts for just 3.1% of California's employment, the high-paying information sector has likely contributed to rising personal income in California. ThinkstockFullscreen

8. California: Personal income growth (2012-2017): +16.6%. As home to Silicon Valley, California is the hub of America's high-paying tech jobs. Employment in California's information industry grew 12.0% over the past decade, a time when the American information industry lost 7.8% of its jobs. Though it accounts for just 3.1% of California's employment, the high-paying information sector has likely contributed to rising personal income in California. ThinkstockFullscreen 7. Oregon: Personal income growth (2012-2017): +17.5%. Personal income rose significantly in Oregon between 2012 and 2017, and it appears that the improvement resulted in a number of state residents exiting poverty. The poverty rate in Oregon dropped from 17.2% in 2012 to 13.3% in 2016 -- the largest percentage point drop of any state during that time. ThinkstockFullscreen

7. Oregon: Personal income growth (2012-2017): +17.5%. Personal income rose significantly in Oregon between 2012 and 2017, and it appears that the improvement resulted in a number of state residents exiting poverty. The poverty rate in Oregon dropped from 17.2% in 2012 to 13.3% in 2016 -- the largest percentage point drop of any state during that time. ThinkstockFullscreen 6. Arizona: Personal income growth (2012-2017): +18.1%. Arizona representatives have convinced several companies to relocate from California, bolstering the state's tech and financial sectors. Over the last 10 years, the number of workers in Arizona's information industry grew 8.7% and its financial industry spiked 14.6% during the same time -- both among the highest growth rates of any state. miroslav_1 / iStockFullscreen

6. Arizona: Personal income growth (2012-2017): +18.1%. Arizona representatives have convinced several companies to relocate from California, bolstering the state's tech and financial sectors. Over the last 10 years, the number of workers in Arizona's information industry grew 8.7% and its financial industry spiked 14.6% during the same time -- both among the highest growth rates of any state. miroslav_1 / iStockFullscreen 5. Washington: Personal income growth (2012-2017): +18.2%. Major tech companies like Amazon are likely the key catalysts behind Washington's high personal income growth. Some 3.8% of workers in Washington are employed in the information industry, a higher share than in any other state. The state's tech industry has undergone massive growth over the last decade, with the number of jobs ballooning 23.5% over the last 10 years. ThinkstockFullscreen

5. Washington: Personal income growth (2012-2017): +18.2%. Major tech companies like Amazon are likely the key catalysts behind Washington's high personal income growth. Some 3.8% of workers in Washington are employed in the information industry, a higher share than in any other state. The state's tech industry has undergone massive growth over the last decade, with the number of jobs ballooning 23.5% over the last 10 years. ThinkstockFullscreen 4. Nevada: Personal income growth (2012-2017): +18.5%. Though Nevada is famous for Las Vegas, the state's leisure and hospitality industry grew less than that of every other state since 2007. Nevada's personal income growth was likely helped most by the education and health services sector, which grew its workforce 43.6% since 2007 and now employs 9.9% the state's labor force. ThinkstockFullscreen

4. Nevada: Personal income growth (2012-2017): +18.5%. Though Nevada is famous for Las Vegas, the state's leisure and hospitality industry grew less than that of every other state since 2007. Nevada's personal income growth was likely helped most by the education and health services sector, which grew its workforce 43.6% since 2007 and now employs 9.9% the state's labor force. ThinkstockFullscreen 3. Colorado: Personal income growth (2012-2017): +18.7%. Colorado's unemployment rate dropped by more than 5 percentage points since 2012 through 2017, one of the largest drops in the country. The leisure and hospitality sector added 63,000 jobs in the past decade, which likely contributed to the state's rise in personal income. It also helped offset the employment decline in Colorado's information industry, which shrank by 4,700 jobs, or 6.2%, over the same time. ThinkstockFullscreen

3. Colorado: Personal income growth (2012-2017): +18.7%. Colorado's unemployment rate dropped by more than 5 percentage points since 2012 through 2017, one of the largest drops in the country. The leisure and hospitality sector added 63,000 jobs in the past decade, which likely contributed to the state's rise in personal income. It also helped offset the employment decline in Colorado's information industry, which shrank by 4,700 jobs, or 6.2%, over the same time. ThinkstockFullscreen 2. Idaho: Personal income growth (2012-2017): +19.0%. Over the past five years, Idaho's employment increased 15.4%, likely contributing to the Gem State's 19.0% personal income growth. The number of manufacturing jobs nationwide declined by more than 10% over the past 10 years. In Idaho, however, the manufacturing industry increased slightly, and it currently makes up 9.3% of the state's workforce. ThinkstockFullscreen

2. Idaho: Personal income growth (2012-2017): +19.0%. Over the past five years, Idaho's employment increased 15.4%, likely contributing to the Gem State's 19.0% personal income growth. The number of manufacturing jobs nationwide declined by more than 10% over the past 10 years. In Idaho, however, the manufacturing industry increased slightly, and it currently makes up 9.3% of the state's workforce. ThinkstockFullscreen 1. Utah: Personal income growth (2012-2017): +20.9%. Utah's personal income has grown by 20.9% since 2012, the highest rate of growth of all 50 states. This boost has come as the state workforce has also grown faster than any other state. Between 2012 and 2017, state employment grew from or seeking work grew from 1.25 million to 1.47 million. That 17.4% increase was the largest of any state. Utah's growing tech industry, which tends to have growing and high wages, likely helped contribute to the state's nation-leading income growth. ThinkstockFullscreenInterested in this topic? You may also want to view these photo galleries:Replay

1. Utah: Personal income growth (2012-2017): +20.9%. Utah's personal income has grown by 20.9% since 2012, the highest rate of growth of all 50 states. This boost has come as the state workforce has also grown faster than any other state. Between 2012 and 2017, state employment grew from or seeking work grew from 1.25 million to 1.47 million. That 17.4% increase was the largest of any state. Utah's growing tech industry, which tends to have growing and high wages, likely helped contribute to the state's nation-leading income growth. ThinkstockFullscreenInterested in this topic? You may also want to view these photo galleries:Replay 1 of 17

1 of 17 2 of 17

2 of 17 3 of 17

3 of 17 4 of 17

4 of 17 5 of 17

5 of 17 6 of 17

6 of 17 7 of 17

7 of 17 8 of 17

8 of 17 9 of 17

9 of 17 10 of 17

10 of 17 11 of 17

11 of 17 12 of 17

12 of 17 13 of 17

13 of 17 14 of 17

14 of 17 15 of 17

15 of 17 16 of 17

16 of 17 17 of 17AutoplayShow ThumbnailsShow CaptionsLast SlideNext Slide

17 of 17AutoplayShow ThumbnailsShow CaptionsLast SlideNext Slide