Walgreen Company (WAG

) reported its fourth quarter results before the opening bell on Tuesday morning, posting a 6.4% increase in revenues and a 1.4% increase in adjusted EPS compared to last year’s Q4.

) reported its fourth quarter results before the opening bell on Tuesday morning, posting a 6.4% increase in revenues and a 1.4% increase in adjusted EPS compared to last year’s Q4.

WAG’s Earnings in Brief

Walgreen reported a fourth quarter loss of 25 cents cents per share, compared to last year’s Q4 earnings of 69 cents per share. On an adjusted basis, earnings per share came in at 74 cents. Sales for the quarter came in at $19.057 billion, up from last year’s Q4 sales of $17.941 billion. The company’s total sales for comparable stores rose 5.4%. Walgreen’s results met analysts’ expectations of 74 cents EPS, and revenue came in just above the expectation of $19.03 billion.CEO Commentary

Walgreens President and CEO Greg Wasson released the following comments: “Our fourth quarter performance was in line with our expectation, recognizing we have much more to do. We closed the fiscal year by exercising the option for the second step of our strategic transaction with Alliance Boots, completing the transition of our pharmaceutical distribution to AmerisourceBergen and driving continued improvement in our daily living business that resulted in our largest year-over-year quarterly and fiscal-year sales increases in three years. While continuing to work through pharmacy margin pressure, we were able to achieve improved top-line pharmacy growth as our retail pharmacy market share for the fiscal year increased 30 basis points to 19.0 percent. Finally, we maintained solid expense control in the fourth quarter and are moving forward with the implementation of our previously announced cost-reduction initiative to achieve $1 billion in savings by the end of fiscal 2017."

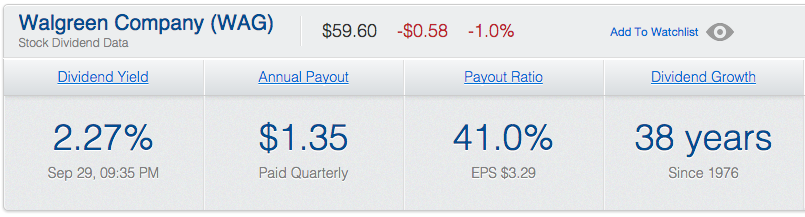

WAG’s Dividend

Walgreens most recently announced a dividend raise in August, pushing its quarterly payout from 32 cents to 34 cents. We expect the company to declare its next 34 cent dividend within the next month or so.

Stock Performance

WAG stock was up $1.40, or 2.35%, in pre-market trading. YTD, the stock is up 5.24%.

WAG Dividend SnapshotAs of Market Close on September 29, 2014

Click here to see the complete history of WAG dividends.

No comments:

Post a Comment