U.S. Steel (X) was the first stock I targeted for my "Too Cheap To Ignore" series of articles.

When my U.S. Steel analysis was published on Seeking Alpha on December 17th, 2015, U.S. Steel shares closed that day at $7.25 per share, as commodity equities were at the tail end of a very difficult bear market.

Yesterday, U.S. Steel shares have closed above $35 per share, at $35.44, for a total gain excluding dividends of 389% from that December 17th, 2015 closing price.

Given such strong gains, is there any upside remaining in U.S. Steel shares?

Building on this narrative, what does the company's per share valuation look like today?

A Long WayU.S. Steel shares have come a long way from their early 2016 lows.

(Source: WTK, StockCharts)

While the gains have been tremendous, U.S. Steel is still below its 2009 & 2010 recovery highs, and nowhere close to 2007, 2008, and early 2009 levels.

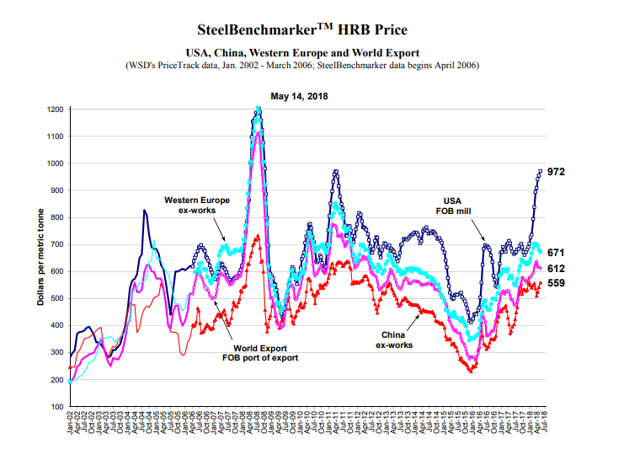

Steel Prices Are Strong TodayU.S. Steel's stock price has clearly been buoyant the past several years, yet steel prices have been even stronger, as the chart from SteelBenchmarker shows below.

(Source: SteelBenchmarker)

(Source: SteelBenchmarker)

From the chart above, it should be obvious that the market does not believe the recent steel price strength is sustainable, because if it did, U.S. Steel shares would be much higher than they are now, as I will show below.

Is U.S. Steel Undervalued Or Overvalued Today?Per the Q1 2018 10-Q, U.S. Steel had 178,289,000 shares of stock outstanding. At a closing price of $35.44 yesterday, this gives the company an equity market capitalization value of $6.3 billion.

From the 10-Q, U.S. Steel had long-term debt of $2.57 billion, alongside cash & cash equivalents of $1.37 billion, so there is $1.2 billion in net debt.

Thus, U.S. Steel's current enterprise value is roughly $7.5 billion.

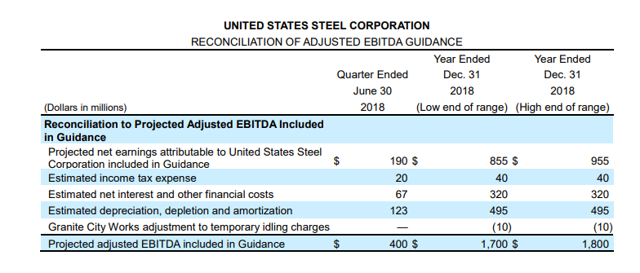

EBITDA for the calendar year 2018, were projected to be $1.7 billion to $1.8 billion in the company's first quarter earnings release.

(Source: U.S. Steel's Q1 Earnings Release)

(Source: U.S. Steel's Q1 Earnings Release)

With an enterprise value of $7.5 billion, and an EBITDA of $1.75 billion at the midpoint of guidance, which is low as I will illustrate below, U.S. Steel is selling for an EV/EBITDA ratio of 4.3.

For reference, commodity equities, including U.S. Steel typically sell at EV/EBITDA multiples of 7-10, with the better quality balance sheet companies trading at the higher end of the multiple. On this note, U.S. Steel, is poised to become net cash positive over the next 12 months, as their net debt only stands at $1.2 billion right now.

If you use a 7x multiple on current earnings estimates, which is at the low end of historical multiples, U.S. Steel's equity fair value per share would be roughly $62 per share. This implies upside potential of 75% in U.S. Steel shares.

However, this even understates the appreciation potential, in my opinion, as earnings estimates have been rising with the increasing steel prices.

(Source: Yahoo Finance with WTK's annotations)

(Source: Yahoo Finance with WTK's annotations)

Given the increase in steel prices, I think U.S. Steel is going to earn over $2 billion in EBITDA this year, and next.

Putting a 7x EV/EBITDA multiple, which again is at the lower end of historical ranges, gives U.S. Steel a $72 per share fair value today. This valuation suggests upside potential of 103% in U.S. Steel common shares.

(Authors Note: For an expanded version of this article in The Contrarian, I have calculated further valuation models.)

Closing Thoughts - U.S. Steel Shares Are Still UndervaluedDespite a strong share price advance from its early 2016 lows, U.S. Steel's shares have not kept pace with the company's fundamental improvement. Thus, using a variety of valuation models, U.S. Steel's shares appear undervalued today, by a material margin. EV/EBITDA models suggest upside potential of 75% to 103%, with respective price targets of $62 to $72 per share based on a 7 times EV/EBITDA ratio, which is a the low end of historical multiples, especially for companies with strong balance sheets, which U.S. Steel currently possesses.

Why do shares remain undervalued?

The answer is that commodities, and by extension commodity equities, get very little respect right now, since commodities are so out-of-favor versus the broader equity market.

(Source: WTK, StockCharts)

(Source: WTK, StockCharts)

With commodities still historically undervalued, and out-of-favor versus the broader equity market, as measured by the S&P 500 SPDR ETF (SPY), even the better fundamentally performing commodity equities remain under-owned, and undervalued, and that is the case for U.S. Steel today.

To close, the investment landscape is changing as commodities made what appears to be a secular low early in 2016, followed by what appears to be a secular low in sovereign interest rates later in 2016. As time cements these turning points, investors will begin to change their future assumptions, and the respective premiums and discounts assigned to sectors within the equity market will change. U.S. Steel shares should be a beneficiary of this positive revaluation. Having said that, this is not a buy-and-hold forever equity, at least in my opinion, so when the winds of valuation change, and U.S. Steel shares are overloved, and overvalued, that will be the time to hit the eject button. We are not there yet, in my opinion.

Thank you for your readership. If you wish to get future public articles from me, please click the "Follow" button.

Rare two-week free trial currently open to The ContrarianRecently we published a 55-page deep dive research article on one of our most compelling long ideas, and to celebrate, we are extending the window for our two-week free trial to The Contrarian. With a two-and-a-half year track record of Model Portfolio��s that have generally significantly outperformed the markets, and their targeted benchmarks, The Contrarian offers a rare window into what we think are some of the best value investments in the stock market today.

Disclosure: I am/we are long X, AND SHORT SPY AS A MARKET HEDGE.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Additional disclosure: Every investor's situation is different. Positions can change at any time without warning. Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

No comments:

Post a Comment