Introduction: The Seeking Alpha Experiment

Warren Buffett began his investing career with $105,000. Now the man is worth $53.5 billion (according to Forbes) Like every other young hot shot investor, I strive to emulate this man's success. With this being said, I won't be terribly upset if in 60 years I'm not the 4th richest man in the world. I'm a realistic person. I have goals that I'd like to meet for myself and my family that aren't as lofty as Mr. Buffett's current financial status. But, I also believe that if you're going to play the game you ought to play to win. And I'd say that without a doubt, Mr. Buffett has been victorious.

This $105,000 initial starting dollar pool also recently caught my attention for another reason. I currently rent a cottage on a horse farm. Sitting in the barn, the farm's manager, a former farm boy who studied economics and computer science in college and made his fortune in the 1980's and 1990's working in Silicon Valley during the original tech boom and making prudent investment decisions in regards to the early tech stocks, said to me: "It's that first $100,000 that's hard to save; once you get there you'll be right as rain." I respect this man immensely and am grateful that after a decade or so on the tech grind in California he decided to move back east and resume farming. He is hard headed and won't let me win easily. He's a wonderful sounding board for me as my economic education continues. I also believe that this relationship is symbiotic; I think secretly he relishes the sometimes heated market related discussions we have, his days around the farm just wouldn't be the same without them.

A common theme of our conversations is the "shoulda, woulda, coulda" investment ideas that I have. He doesn't buy them. Talk is cheap and I understand that. Unfortunately, I'm also cheap (or young and poor, rather) and don't often have resources available to fund my theoretical investment plans. Because of this I decided that I would document these ! ideas. I thought that this documentation would sever as a long-term accountability measure for readers on this site and prove to my old farmer friend that I'm not just some know-it-all kid with an answer for everything.

I took this $100,000 idea and ran with it. I decided that beginning January 1st, 2013 I would invest this theoretical sum of money, creating what I call The Seeking Alpha Experiment. This is the first installment of what will be many pieces and updates regarding this imaginary fund. I always enjoy reading articles focused on strategic portfolio management. They allow me to gain a deeper understanding of the total thought process that is used when building a portfolio. I hope that this piece serves the same purpose for you. I will explain the decisions that I've made while performing this experiment in chronological order, starting January 1, 2013 and ending with the quarter on March 31, 2013.

General Investment Philosophy:

I mentioned Buffett before as my inspiration. I try my hardest to always look at potential investments through the eyes of a business man. With this being said, I'm not a very technical or data driven guy. I examine fundamentals and historical earnings. I analyze charts and graphs, looking for trends and deviations. And most importantly, I try to go with my gut. The mind is a powerful tool but I also believe in the inherent purity of the heart and the instinctual fear, guilt, and regret that sometimes stirs in the pit of my stomach. I take a stoic approach, keeping my emotions at bay while attempting to profit off those of others. This comes easy for me; as a former high school quarterback I learned the importance of keeping a level head: never too low, never too high. It is the patience aspect of value investing that is difficult for me. I have read Graham and truly agree with his ideals concerning evaluation. I closely follow Buffett's moves, trying to decipher the inner workings of the mind of a financial genius. I look for value and find it by tak! ing a bul! lish, contrarian approach to the market's drastic short term moves against the best of breed and wide moated dividend paying stocks that I monitor on a daily basis. In my admittedly short experience as an investor I have noticed that many of these dips in price are driven by fear. Some of these downward surges seem to be related to profit taking, but sometimes they seem whimsically irrational. These are the buying opportunities that I live for. They require patience and resiliency in regards to intestinal fortitude; it's impossible to predict the bottom of a downward trend. Because of this, I make it a mathematical game. I look at these dips as a margin of safety. 6% is a number that gets my attention and I like to buy into drops in the 8+% range.

I like dividends. They give me a peace of mind as I view them as a sort of safety margin as well. I try and focus on companies with historical dividend growth so that I can feel comfortable in the inevitable bear market situation collecting predictable cash. It is very important to have cash available during these moments when long term value becomes most widely available. With this being said, I do not consider myself as a true dividend growth investor or as someone who is purely seeking income from their holdings. Long term appreciation is what matters most to me due to my age and I have tried to secure a hybrid balance between dividend growth and the potential upside of the stocks I own.

I look for wide moats and recognizable brands. Right now, I feel confident that in American securities is the place to be so during Q1 I have focused mainly on domestic brands.

The Portfolio:

Many of these stocks have been more closely examined in previous articles that I've written (several of the positions added in this experiment are correlated to these articles). If you are interested in a more in-depth analysis of these companies please refer to the afore mentioned articles.

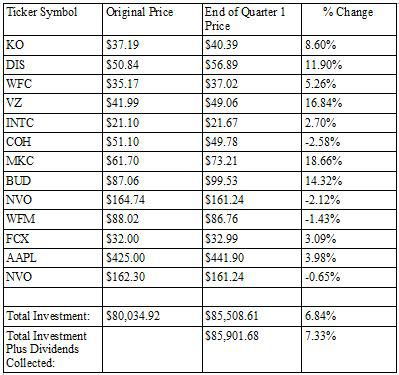

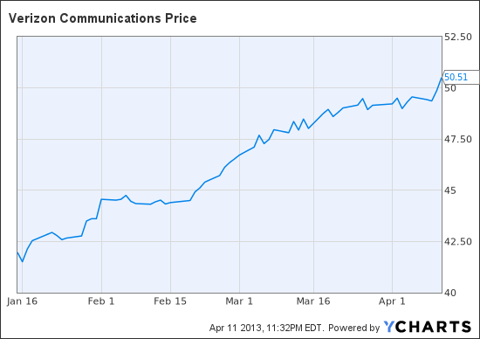

(click to enlarge)

(click to enlarge)

The Core:

I knew that I would need an anchor. What does an anchor do? It holds the ship steady in rough waters. I chose two of the most iconic American brand names to serve his purpose. My core positions are Coke (KO) and Disney (DIS). I love both of their products and don't foresee either company having problems with their primary earnings drivers in the near future.

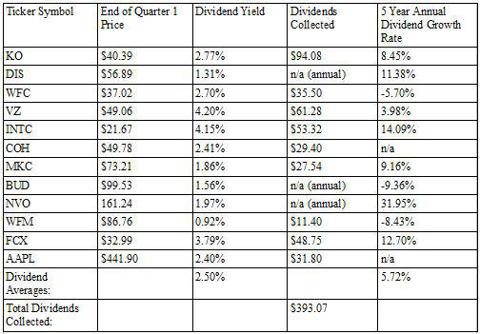

Coke has one of the most defensible moats that I've found with 16 $1 billion brands under its belt. KO sells its 3500 products in over 200 countries worldwide. The company has shown steady growth for decades and boasts one of the market's most reliable dividends which it has increased for 50 consecutive years. I think Coke does an excellent job with its brand marketing and I feel comfortable trusting my money to the company's management team.

I've had a soft spot in my heart for Disney ever since I was a small child. Being a sports fanatic I watch an incredible amount of ESPN. This investment isn't about sentimental value though. I also watch sports on other networks can sincerely believe that ESPN has managed to acquire the best talent in the business. From production teams to the individual anchors, in my opinion Disney's ESPN network takes the cake. I am also confident that sports will be a mainstream form of entertainment for our society for decades to come and I believe ESPN has positioned itself perfectly to continue to capitalize of this public interest.

I also like Disney's recent acquisition of Lucasfilm. I know that the Star Wars series is in a bit of a rut due to the disappointment of the recent additions to the motion picture story! line but ! I think Disney can turn this around. I say this because of the company's success with the Marvel films. I know these tracks aren't exactly parallel but DIS took plots from a failing comic industry and revived these characters, giving them public appeal that they haven't had in decades. I also know that Walt Disney, the creator and founder of the company, laid out future growth guidelines for his life's work for years to come. He was a grand thinker and I feel comfortable entrusting my dollars to his legacy.

DIS's dividend is not as historically noteworthy as Coke's however Disney's 5 year annual dividend growth rate is an impressive 11.38%.

These two core positions make up 25% of my potential original holdings. After having decided this I purchased $12,500 worth of stock in each company shortly after the opening bell of January 2, 2013. I bought 336 shares of Coke at $37.19/share and 246 shares of Disney at $50.84/share.

Below are charts showing the performance of these two core positions since their purchase dates (I will include these charts for each position in the portfolio):

(click to enlarge)

KO data by YCharts

(click to enlarge)

DIS data by YCharts

The Positions:

Wells Fargo & Co:

I knew that I wanted exposure to the financials. I saw this sector as a whole as being extremely under valued. When looking at the major banks I narrowed down my choices to Wells Fargo & Co (WFC) and JP Morgan Chase (JPM). Ultimately, Buffett made this decision for me. I had been considering WFC since the first of the year after having seen that Buffett added to his position in Wells Fargo on 12/31/2012, making it the most prominent holding of Berkshire Hathaway. While I saw WFC and JPM as near equals, I decided to fo! llow in t! he footsteps of the man who greatly inspired this experiment and my investing career as a whole (BRK's cost average for WFC is $33.71; I bought in at $35.17, already 4.33% behind the eight-ball, but I felt confident in WFC's future growth prospects and feel comfortable making this company a long term holding in my portfolio) . I like WFC's diverse product line (commercial, consumer, and investment banking services). Wells is a paramount player in the domestic mortgage origination sector and I believe that the company will greatly benefit from an improving American housing market. WFC boasts a much higher dividend yield than many of its major competitors (2.70% on date of purchase). I remain bullish on WFC and have no plans of making changes to this position within my portfolio.

(click to enlarge)

WFC data by YCharts

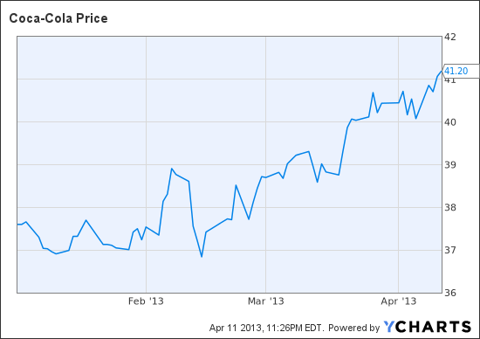

Verizon Communications Inc.:

I know that I would need several stocks with steady and reliable high yields. Verizon (VZ) fits this mold perfectly and I believe it to be the best in breed choice among wireless communications companies. VZ has been on an upward trend throughout the second half of 2012 and the early part of 2013. Because of this I set a $42 entry point (I felt this to be fair value for the company) and managed to pick up shares of VZ on January 15th, 2013 just under this target price. VZ's 4.13% yield is currently the highest in my portfolio. VZ has shown steady and reliable dividend growth and I don't expect for this to change. The company is constantly improving and increasing its infrastructure (fiber-optic, land line, and wireless). VZ services nearly 100 million retail customers in the US. I see the telecommunications industry as an indirect play on the smartphone market as well. The mobile technology sector is cut throat and unpredictable; therefore, I like the idea of gaining exposure through the providers rather than the hardware! manufact! urers. Verizon's moat extends further than that of a purely wireless provider. The company maintains an advanced fiber-optic network enabling it to venture into integrated business solutions. According to the company's website VZ offers these services to customers in more than 150 countries. This international exposure gives the company expansive room for growth.

I do worry about VZ's high debt load and the potential troubles that the company might face when the federal QE ends and interest rates begin to rise. I will be monitoring news on this front closely and may potentially take profits from Verizon (at the end of Q1 this position was up 16.84%) if I begin to believe that this move would be in my best interests.

(click to enlarge)

VZ data by YCharts

Intel Corporation:

In my actual personal portfolio (not this theoretical experiment). I managed to pick up this semi-conductor giant in November at $19.38 a share shortly after it was announced that the company's CEO Paul Otellini was going to retire. I bought the stock near the bottom of a sizable dip caused by information that doesn't scare me over the long term. Even without its leader INTC is still a great company with a very recognizable brand who is currently investing into its future. I love owning stocks that invest in themselves; to me this represents supreme confidence coming from company management.

Unfortunately for me, November 26, 2012 doesn't fall into the time range of this experiment. I remain confident in the moves that Intel is making to re-position itself after having missed the initial massive opportunity to move into mobile. On January 18, 2013, after the stock had risen above the $23 threshold during the first few weeks of the year, I got another opportunity to buy a great company at a discounted price and bought shares for my self and for this theoretical portfolio at $21.10/sh! are. I ha! ve no plans of altering this position in the near future. I really like the company's 4% dividend. I have a multi-year horizon for my expected growth in share price and will happily collect dividends while I wait for this appreciation to occur.

(click to enlarge)

INTC data by YCharts

Coach Inc.:

Coach (COH) has become one of the predominant brands in luxury hand bags. This classic American brand has been falling for 9 months now due to fears that it can't compete effectively against its competitors. At my purchase price the company was trading at roughly 14x earnings. Michael Kors Holdings Ltd., Coach's largest rival currently trades at 32.5x earnings. Coach's bags are still sought after in the market place and I see this recent lack of investor confidence to be a short term phase. COH maintains a 72.76% gross margin and a 21.31% net profit margin. The company's management effectiveness statistics caught my eye as well (ROA: 32.93%, ROE: 53.18%, ROI: 43.77%). COH pays a $0.30 quarterly dividend which represents a 2.41 yield on cost of my original purchase. The company's payout ratio is 30.5%. Coach does not have a strong history of dividend growth; this is a company that I bought into because I believe it to be severely under valued. I believe that this stock is due for a rebound and I hope to take profits off of it when it does.

(click to enlarge)

COH data by YCharts

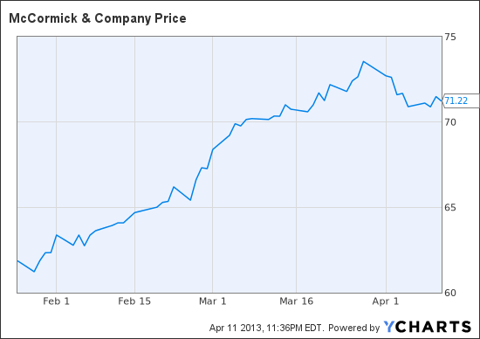

McCormick and Company Inc.:

McCormick (MKC) was the clearest buy that I ran across this quarter. I own this stock in my actual portfolio as well as in The Seeking Alpha Experiment. MKC's stock price fell drastically after is 4th quarter earnings release. However, when looking at the numbers I realized that the company set records for revenue, net income, an! d EPS. Th! ese numbers did not meet analyst expectations which is why the stock fell. MKC does support a rather high P/E of 23x and some of this selloff was likely related to profit taking. However, when looking at the long term growth of the company's share price, its prominence within the spice trade, and the fact that MKC (especially in the post dip $60 price range) seemed to be a perfect acquisition candidate, it's lofty P/E did not dissuade me. MKC has given shareholders an annual return of 13% over the past 10 years. McCormick also pays a healthy dividend (1.86% at quarter's end) which it has increased for 27 consecutive years. The company's most recent dividend increase was 10%. MKC's current payout ratio is 42%. This number seems reasonable after MKC's record earnings year. I have no immediate plans for my position in MKC. I believe this stock to be of core holding quality and plan on adding to this position on any significant dips.

(click to enlarge)

MKC data by YCharts

Anheuser Busch InBev SA:

InBev (BUD) signaled on my radar after complications with the Department of Justice who had anti-trust concerns over InBev's plans to merge with Grupo Modelo. BUD's stock had been flying high, showing a strong upward trend and this news and the market's response (a nearly 10% fall in stock price) gave me an opportunity to buy into the classic American alcohol manufacturer. Since this purchase on January, 31 2013 at $87.06/share the stock has steadily regained and surpassed its pre-injunction price point due to meetings with the DOJ, Grupo Modelo and Constellation Brands (STZ) and the belief that a merger agreement could be reached. I thought that this was another example of an irrational sell off and happened to be correct (thus far at least).

Before BUD's late January selloff I was having a hard time discerning between BUD and Diageo (DEO), an internationally focused! alcohol ! company. InBev pays an annual dividend of $2.21 which amounts to a 2.54% yield on cost (1.56% yield at end of quarter stock price). DEO currently boasts a 2.32% dividend yield. Both stocks carry a 5 year 0.8 Beta which I like. Ultimately, the 10% dip made my mind up for me; however, due to BUD's recent price appreciation I may decide to take profits in the near future and head in the direction of the higher dividend and international growth, picking up shares of DEO which are currently available at a better earnings multiple: 22.9x compared to 19.6x .

(click to enlarge)

BUD data by YCharts

Novo Nordisk A/S:

If you've read any of my recent articles of Novo Nordisk (NVO) you'd know that I am very Bullish on this stock. NVO produces treatments for Diabetes: a disease that I believe will only continue to proliferate until higher quality, more natural foods are available to humans. Unfortunately, I don't see this happening anytime soon on a broad scale; I actually see the food industry continuing to head in the other direction. This saddens me but not so much that I'm opposed to profiting from the situation. NVO boasts a 10 year 27.47% CAGR and a consistently increasing dividend. I've purchased shares of this stock twice for The Seeking Alpha Experiment portfolio, once on February 11th and again on March 21st after declines in price of 15% and 12%. These dips were because of the FDA's rejection of two drugs expected to be big earnings catalysts for NVO. This will be a detriment to the company's earnings potential in the near term, but I still believe in NVO over the long haul; enough to enter two full positions, essentially making NVO a core position in the portfolio.

(click to enlarge)

NVO data by YCharts

Whole Foods Market Inc.:

I b! ought shares of Whole Foods Market (WFM) on February 14, 2013 after the company experienced a 10.13% drop in share price. WFM carries the high P/E multiple of a growth stock: 32.6x. I wouldn't typically want to own a stock trading at such a high multiple but I do believe that Whole Foods' thinking and business plan is revolutionary and ahead of the curve. I also really respect the company's CEO, John Mackey, for his philosophy concerning free market economics and how a business should be run. Mr. Mackey isn't as concerned with shareholder return as he is with customer satisfaction and ultimately, company strength and performance. Because of this WFM pays a slight dividend: 0.92%. WFM isn't know for dividend growth (in fact, the company has cut its dividend in recent years); however, multiples aside, I think this company is undervalued at its current price range.

Since purchasing the stock it has continued to fall. I am monitoring this one more closely than others as I've become wary of this trend. I thought that in this forgiving rally that the market experienced throughout the first quarter that WFM's original drop in price was another over reaction. I could have miscalculated this one. You will notice that since this purchase I've been more conservative with my theoretical cash. I've had the feeling that a considerable market pullback is looming for some time now and I believe that in such a case, there will be better buying opportunities than there are in this current bull market.

(click to enlarge)

WFM data by YCharts

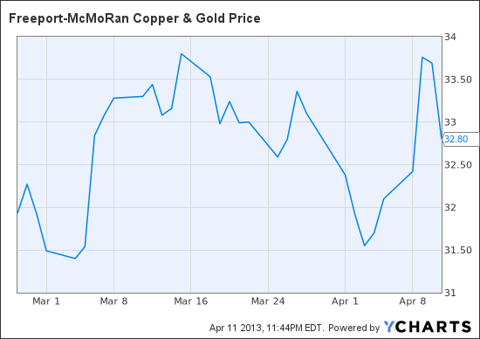

Freeport-McMoran Copper and Gold Inc.:

I've been eyeing this stock since its major (21.75%) pullback in early December 2012 on the news of Freeport's (FCX) acquisition of McMoRan and Plains. While the market's general consensus regarding this move was negative, I believe this foray into the domestic energy market will be a positive FCX in! the long! term. I was looking for precious metals exposure and don't mind the diversification into energy all in one fell swoop. Since its initial fall, FCX's stock had regained much of its value throughout January and February, climbing to the $36 range. I had a $32 entry point in mind for this stock. I picked up shares of FCX on February 26, 2013 after a 13% drop in share price. At the end of Q1 FCX boasted a 3.79% yield; one of the highest in the portfolio. I believe that the stock itself has quite a bit of upside and have no plans to change this full position in the near future.

(click to enlarge)

FCX data by YCharts

Apple Inc.

Owning shares of Apple (AAPL) right now makes me nervous. This is not due to any fears in regards to the company's product line but because of the recent drastic shift in investor sentiment for this company. Apple was a market darling so years throughout its monumental rise but due to its similarly dramatic fall, many investors, both retail and commercial, seem to have negative feelings for AAPL and I worry that this will hold the price down irrationally. Personally, I believe the company's recent fall from prominence to be irrational. I'm not necessarily saying that Apple deserves to be priced in the $700 range, but I am saying that a company with an operating income of $55 billion, a 41.91% gross margin, and strong product portfolio doesn't deserve a 9.9x P/E ratio. I believe that Apple recent sell off has been overly emotional and fear driven; I think that buying into this negative trend will lead towards profits. I had a $425 entry point in mind and was able to purchase shares at this price on March 6, 2013. Apple pays a 2.40% dividend which I will happily collect while waiting for the price appreciation that I expect. Due to its volatility I will be monitoring this position closely. On any large upswing I may take profits and I may add to! this pos! ition if the stock continues to fall. My heart and mind aren't set when it comes to AAPL; I will have to play this one by ear. I will keep you updated.

(click to enlarge)

AAPL data by YCharts

Cash:

At quarter's end I still have $20,358.15 cash on hand ($19,965.08 not invested throughout the quarter plus $393.07 dividend collected). I mentioned that patience plays a large role in my investor philosophy and it is important for me to have cash reserves available to capitalize on valuable market movements. This cash position represents 19.23% of the total portfolio value at the end of Q1: 105866.76.

The Future of The Seeking Alpha Experiment:

I plan on continuing to do quarterly reviews of this project. I will also post real time updates to this portfolio via stock talks here on Seeking Alpha and complete articles when motives or news pertaining to the stocks in question is note worthy.

I am relatively new to investing and I hope that any followers of this experiment will learn as much as I will throughout this project.

Disclaimer: I will not be taking commission costs into consideration as these vary from broker to broker and will likely play an insignificant role in the overall value on this portfolio.

Disclosure: I am long INTC, MKC, WFC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment