BALTIMORE (Stockpickr) -- Put down the 10-K filings and the stock screeners. It's time to take a break from the traditional methods of generating investment ideas. Instead, let the crowd do it for you.

>>5 Hated Earnings Stocks You Should Love

From hedge funds to individual investors, scores of market participants are turning to social media to figure out which stocks are worth watching. It's a concept that's known as "crowdsourcing," and it uses the masses to identify emerging trends in the market.

Crowdsourcing has long been a popular tool for the advertising industry, but it also makes a lot of sense as an investment tool. After all, the market is completely driven by the supply and demand, so it can be valuable to see what names are trending among the crowd.

While some fund managers are already trying to leverage social media resources like Twitter to find algorithmic trading opportunities, for most investors, crowdsourcing works best as a starting point for investors who want a starting point in their analysis. Today, we'll leverage the power of the crowd to take a look at some of the most active stocks on the market today.

>>5 Rocket Stocks Ready for Blastoff

These "most active" names are the most heavily-traded names on the market -- and often, uber-active names have some sort of a technical or fundamental catalyst driving investors' attention on shares. And when there's a big catalyst, there's often a trading opportunity.

Without further ado, here's a look at today's stocks.

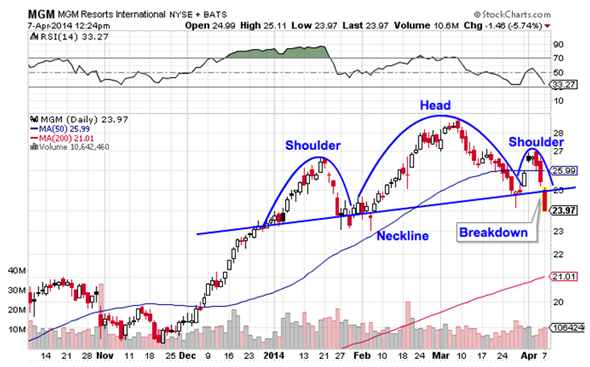

MGM Resorts

Nearest Resistance: $25

Nearest Support: $21

Catalyst: Technical Setup

MGM Resorts (MGM) is getting hammered lower for technical reasons this afternoon. Shares of the $11.8 billion casino stock are unwinding by more than 5% after breaking down through a textbook technical price pattern. MGM had been forming a head and shoulders top for the last several months, threatening a critical breakdown on a move through the pattern's neckline at $25. Well, we're getting that breakdown today.

The downside target for MGM is down at $21. That doesn't mean that shares will be able to bounce there -- it just means that there's a high probability that MGM will retrace to at least that $21 level. If the current environment continues, MGM could conceivably move even further down. Don't look for a bargain opportunity in this stock until it carves out some semblance of support again.

Questcor Pharmaceuticals

Nearest Resistance: N/A

Nearest Support: $80

Catalyst: Buyout

A buyout offer is buoying shares of Questcor Pharmaceuticals (QCOR) by more than 15% in today's session, following news that Dublin-based pharma firm Mallinckrodt (MNK) will pay cash and stock valued at $82.64 for each share of QCOR (as of this writing). After this morning's big gap higher, shares have been fading over the course of the session, widening the merger arbitrage gap to more than 6% as I write. That's a lot of risk put on the merger going through -- and a big potential profit for speculators willing to risk some capital on the news.

While the event risk is too high to qualify QCOR as a worthwhile technical trade, merger arbitrageurs have one of the most interesting setups this market has seen in quite some time. And they've got this weakening market to thank for it. If you can stomach the risk, buying QCOR looks attractive here.

To see these stocks in action, check out the at Most-Active Stocks portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

RELATED LINKS:

>>5 Stocks Poised for Breakouts

>>Chart Smarts: Trade These 5 Big Stocks for Gains in April

>>3 Stocks Rising on Big Volume

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to

TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation.Follow Jonas on Twitter @JonasElmerraji

No comments:

Post a Comment