Click for more market data.

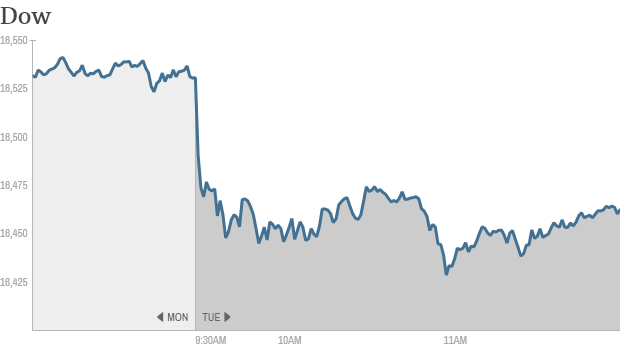

NEW YORK (CNNMoney) Tuesday has been a lucky day for stock market bulls, but this particular Tuesday is not working out for them.The Dow Jones industrial average, the S&P 500 and the Nasdaq were all down at midday, calling into question the recent streak of winning Tuesdays. The Dow has been off around 75 points all day.

The S&P 500 has gained every Tuesday for the past eight weeks. So far this year, the index has advanced every Tuesday except for two.

The trend has been attributed to the Federal Reserve's bond buying program, mutual fund flows and trading algorithms. But at least one trader on StockTwits seemed skeptical that there was anything particularly special about Tuesday.

"$SPY Always up on Tuesday, nothing could possib-lie go wrong," read a post by NaveenB.

Another theory is that Tuesdays are merely a reversal of losses on Monday, though that was not the case this week. Stocks ended modestly higher yesterday, just days after the Dow hit an all-time high.

With the market at such lofty levels, investors seem skeptical about pushing stocks too high. The CNNMoney Fear and Greed index shows investors are still feeling fearful.

Twitter (TWTR) shares led the plunge, hitting a new low as the "lock-up" period for company insiders to sell the stock expired. Under federal securities law, company founders and executives must wait six months before selling any shares following an initial public offering.

The stock is now trading under $35 a share -- that's still above its IPO price of $26 -- but it's the lowest trading price for the social media giant.

"Must be gut wrenching to watch your insider shares plummet from 74 to 35 before you can sell them $TWTR #imaginaryweathvanished," read a post by LincolnList.

Apple (AAPL, Fortune ! 500) shares erased earlier gains, but managed to hold above $600. The stock closed above that level Monday for the first time since October 2012. Apple recently announced a stock split that will take place in early June.

"$TWTR If you want to recover from your losses, buy $AAPL: a real company," read a post by BlackBerril.

Apple stock is an iPhenomenon

Apple stock is an iPhenomenon Drugmaker Merck (MRK, Fortune 500) announced that it will sell its consumer care business to Bayer AG for $14.2 billion. It was the latest in a recent spate of larger mergers in the pharmaceutical industry. Merck stock is down today.

Target (TGT, Fortune 500)continues to drop. Shares are down more than 3% again today. Target's CEO announced he was stepping down yesterday, adding to concerns about the direction the company is headed.

DirecTV (DTV, Fortune 500) shares gained after the satellite TV company reported stronger-than-expected earnings, despite a quarterly slide in net profit year over year. It's one of the top performers in the S&P 500 today.

Office Depot (ODP, Fortune 500) shares also surged after announcing solid earnings and plans to close 400 stores.

Well known brands Groupon (GRPN), Disney (DIS, Fortune 500) and Whole Foods (WFM, Fortune 500) will report after the close.

For the rest of the week, analysts say the biggest market moves will be testimony from Federal Reserve Chairman Janet Yellen on Wednesday, a meeting of the European Central Bank on Thursday, and ongoing tensions in Ukraine.

In Europe, investors were parsing through major bank earnings from UBS (UBS) and Barclays (BCS).

Shares in Barclays fell after the British bank released worse-than-expected quarterly numbers.

Shares in UBS were! inching ! up after the Swiss bank said it would pay a special dividend.

Credit Suisse (CS) was also in focus amid reports the bank could be hit with a criminal penalty as it negotiates with the U.S. government over charges it helped American clients avoid taxes.

Overall, European markets were mixed in morning trading. Barclays was dragging the London FTSE 100 index down.

Markets in Japan, South Korea and Hong Kong were closed Tuesday. But the other Asian markets made gains. ![]()

No comments:

Post a Comment